原标题:An integrated method based on hesitantfuzzy theory and RFM model to insurance customers’ segmentation and lifetimevalue determination

作者:Chun Yan, Haitang Sun, Wei Liu and JinChen

关键词:Property insurance customers, customerlifetime value analysis, customer classification, hesitant fuzzy set

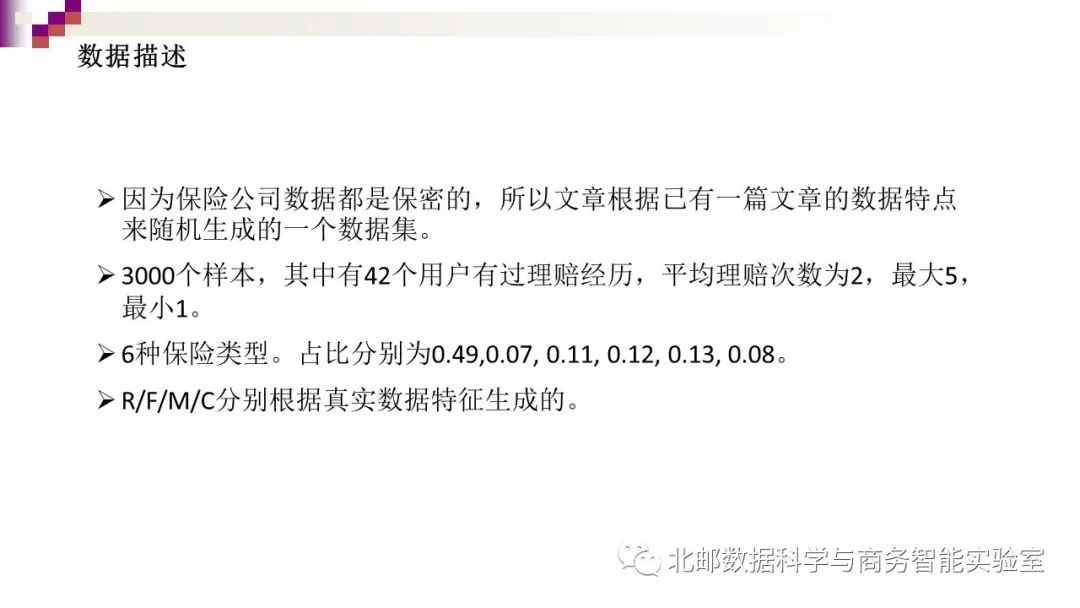

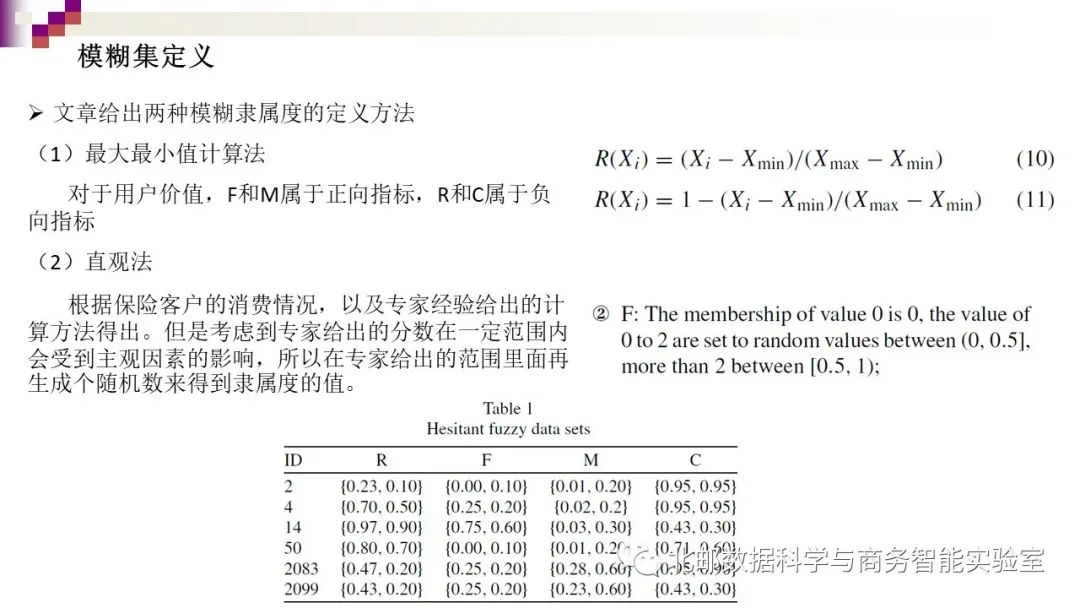

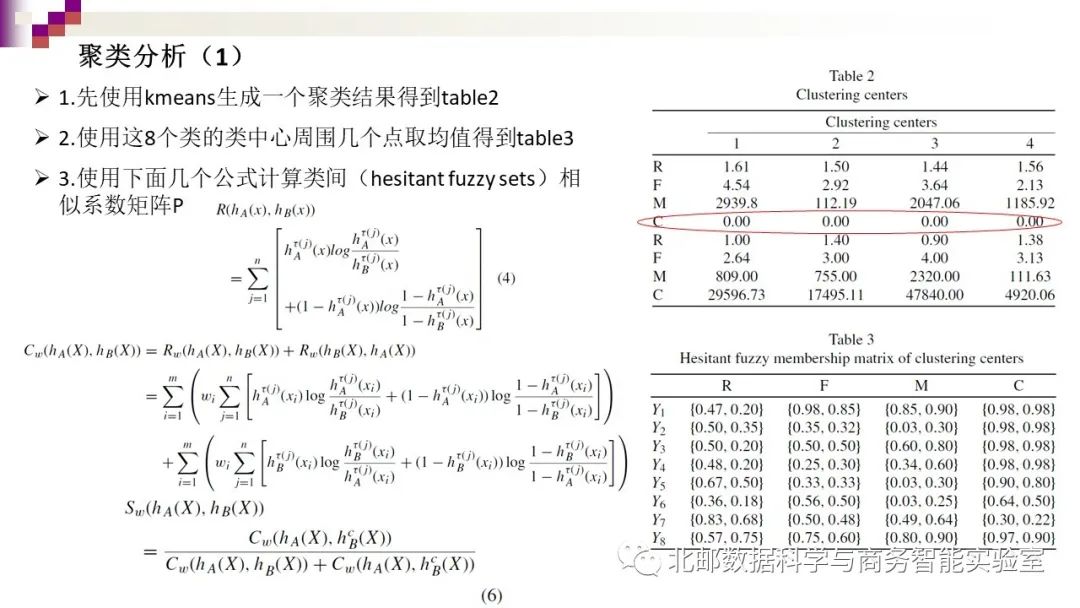

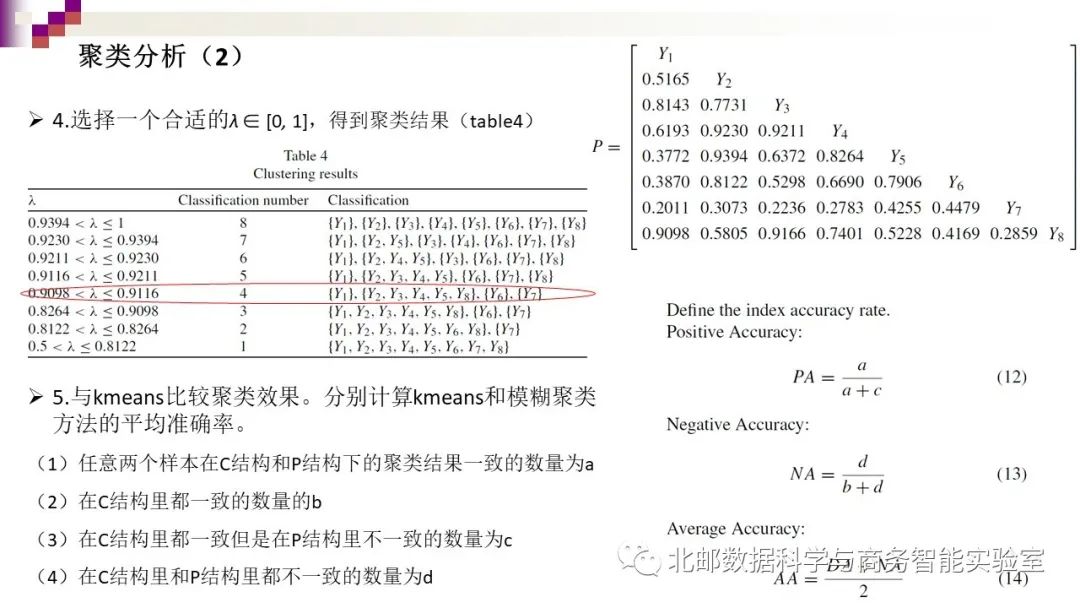

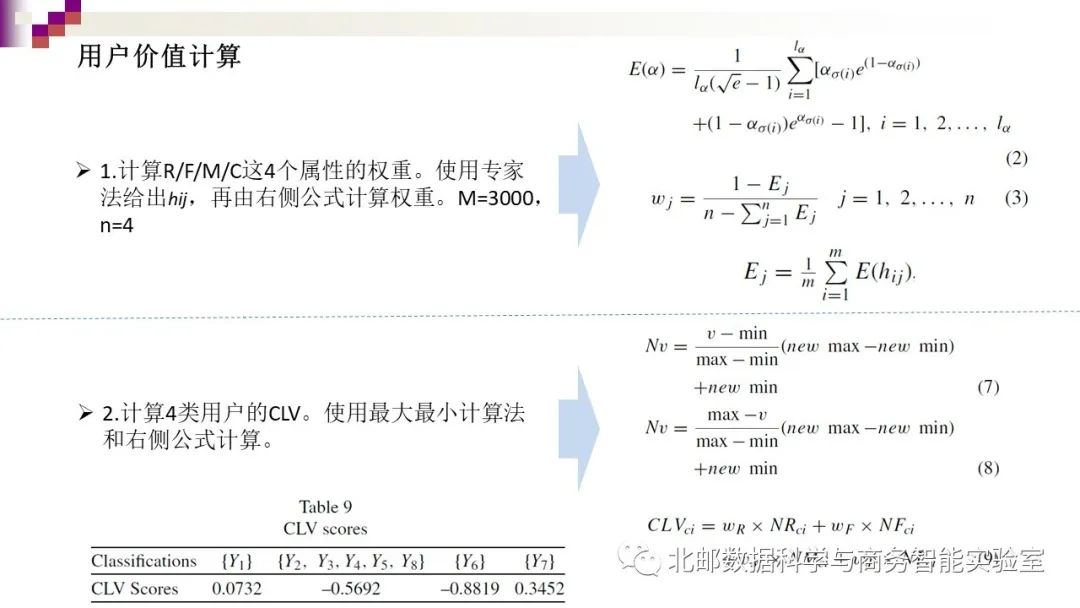

中文摘要:通过对财产保险公司客户终身价值的分析,不仅可以帮助公司合理配置客户关系管理资源,节约管理成本,还可以帮助公司及时有效地识别风险,从而实现风险控制和管理。本文在RFM模型的基础上,引入客户风险索赔指标,对财产保险客户的终身价值进行定量评估。同时,针对实际决策中存在的大量不确定性,文章使用模糊理论对各个属性进行模糊熵加权。其次,使用基于模糊集的相似度测量理论进行聚类分析,从而得到四类用户群里。最后,通过定量的方法计算这四组用户群的全生命周期价值得分,并逐个分析他们的特点。

英文摘要:The analysis of lifetime value ofproperty insurance company customers can not only help the company to allocatecustomer relationship management resources reasonably, save the managementcost, but also help the company to identify risk timely and effectively, sothat the risk control and management can be implemented. In this paper, basedon RFM model, adding claim index of evaluating clients’ risk is to evaluate thelifetime value of property insurance customers quantitatively. At the sametime, in view of massive uncertainties in practical decision-making, withhesitant fuzzy theory, the attributes will be weighted by hesitant fuzzyentropy. Secondly, the similarity measure theory based on hesitant fuzzy set isused to do cluster analysis and four customer homogeneous groups are obtained.Finally, calculate the lifetime value score of these four groups based on aquantitative method and analyze their characteristics from the quantitativeperspective.

文献总结:

点击“阅读原文”了解原文详情!