zw 开源量化团队 QQ 群:533233771

作者:ZW=智王+字王 2016.02.01

摘自:《zw 量化实盘·开源课件》系列

更多量化资料,请浏览 zw 网站:http://ziwang.comQQ 群:124134140 (zw 量化&大数据)

1

前言.................................................................................................................................................................................... 5

INTRO 简介......................................................................................................................................................................... 6

TUTORIAL 教程................................................................................................................................................................... 7

编程文档.......................................................................................................................................................................... 27

bar –k 线数据包,价格数据 ........................................................................................................................................... 28

barfeed,k 线数据........................................................................................................................................................... 34

CSV 数据文件................................................................................................................................................................... 35

Yahoo! Finance 雅虎金融................................................................................................................................................. 36

Google Finance 谷歌金融 ................................................................................................................................................ 37

Quandl 数据 ..................................................................................................................................................................... 37

NinjaTrader 数据 (忍者交易员)...................................................................................................................................... 38

过滤示例 .......................................................................................................................................................................... 39

Moving Averages 移动平均线 ......................................................................................................................................... 41

动量指标过滤 .................................................................................................................................................................. 42

其他技术指标 .................................................................................................................................................................. 44

2

基础模块 .......................................................................................................................................................................... 49

Backtesting 回溯模块 ..................................................................................................................................................... 54

Position 价位 .................................................................................................................................................................... 66

strategyanalyzer 策略分析 .............................................................................................................................................. 68

Returns 收益率策略......................................................................................................................................................... 68

Sharpe Ratio 夏普比率..................................................................................................................................................... 68

DrawDown 减少策略....................................................................................................................................................... 69

Trades 交易模块 .............................................................................................................................................................. 69

策略示例 .......................................................................................................................................................................... 70

Subplot 子图..................................................................................................................................................................... 73

TOOLS 工具 ...................................................................................................................................................................... 77

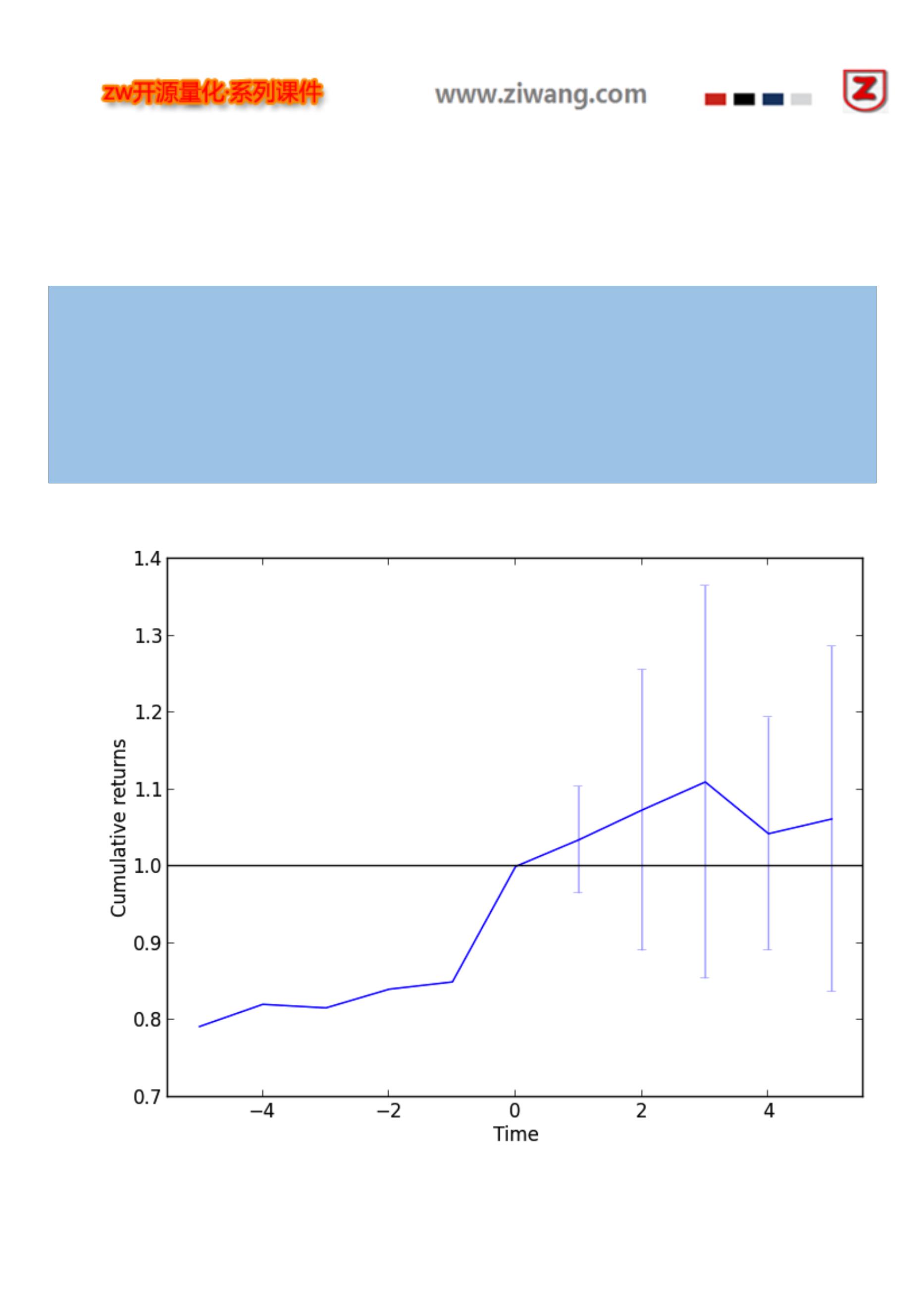

EVENT PROFILER 事件嗅探器 ........................................................................................................................................... 80

XIGNITE 数据公司 ............................................................................................................................................................ 84

3

XIGNITE_EXAMPLE ..................................................................................................................................................................... 85

BITCOIN 比特币................................................................................................................................................................ 88

TWITTER 推特................................................................................................................................................................. 100

TALIB 金融算法库集成................................................................................................................................................... 105

量化投资课程 1.............................................................................................................................................................. 116

量化交易·策略示例........................................................................................................................................................ 120

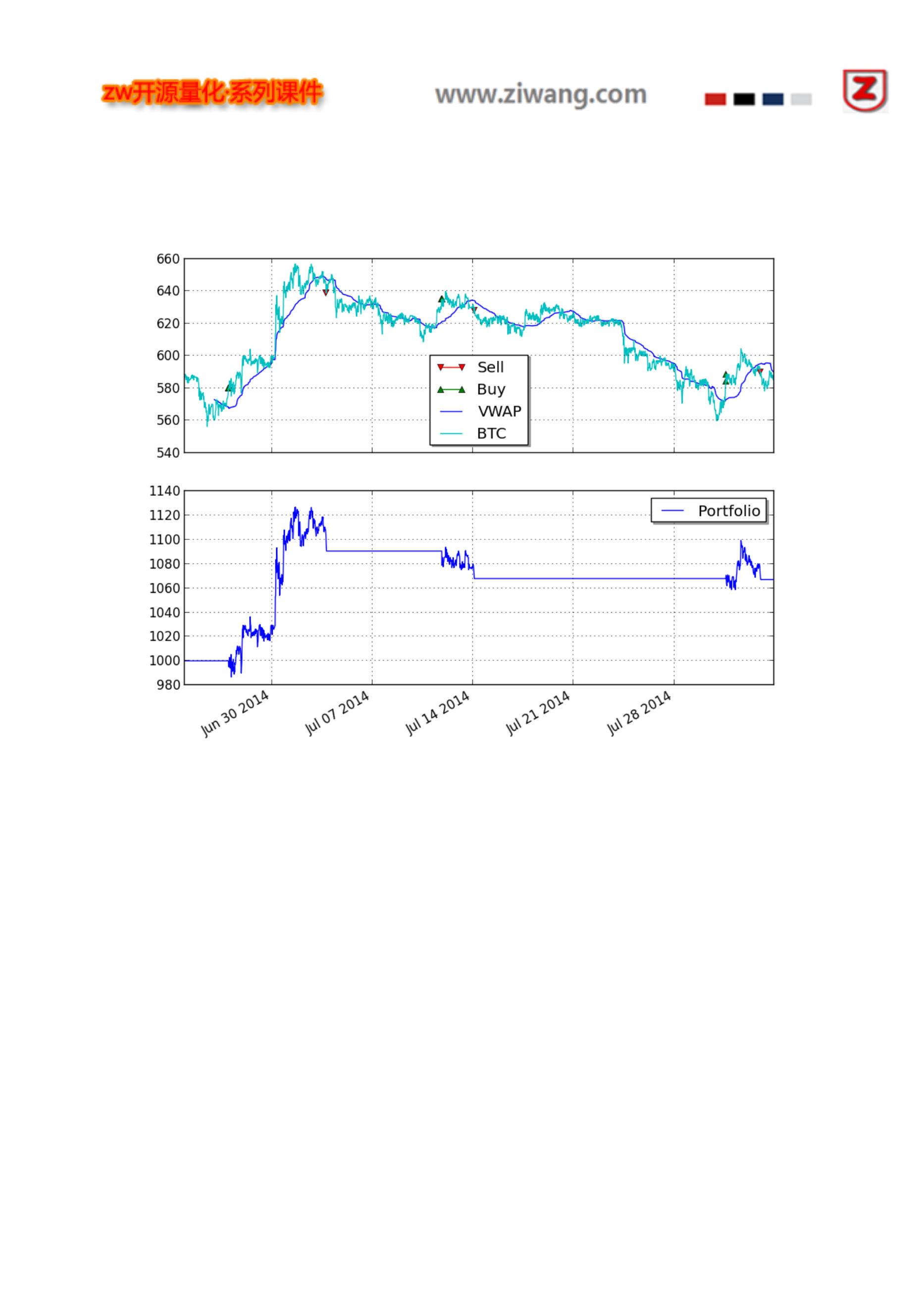

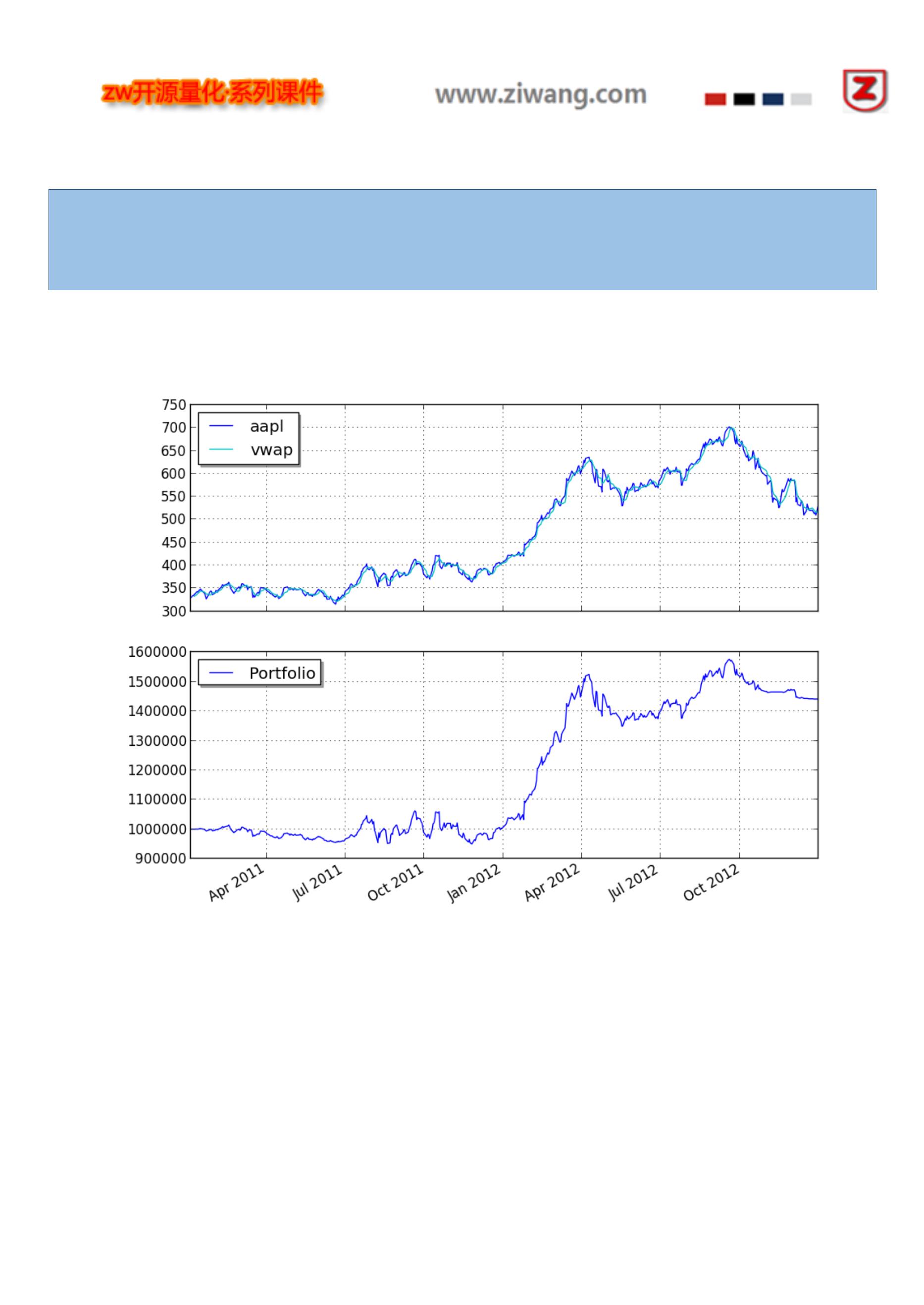

vwap 动量策略 .............................................................................................................................................................. 121

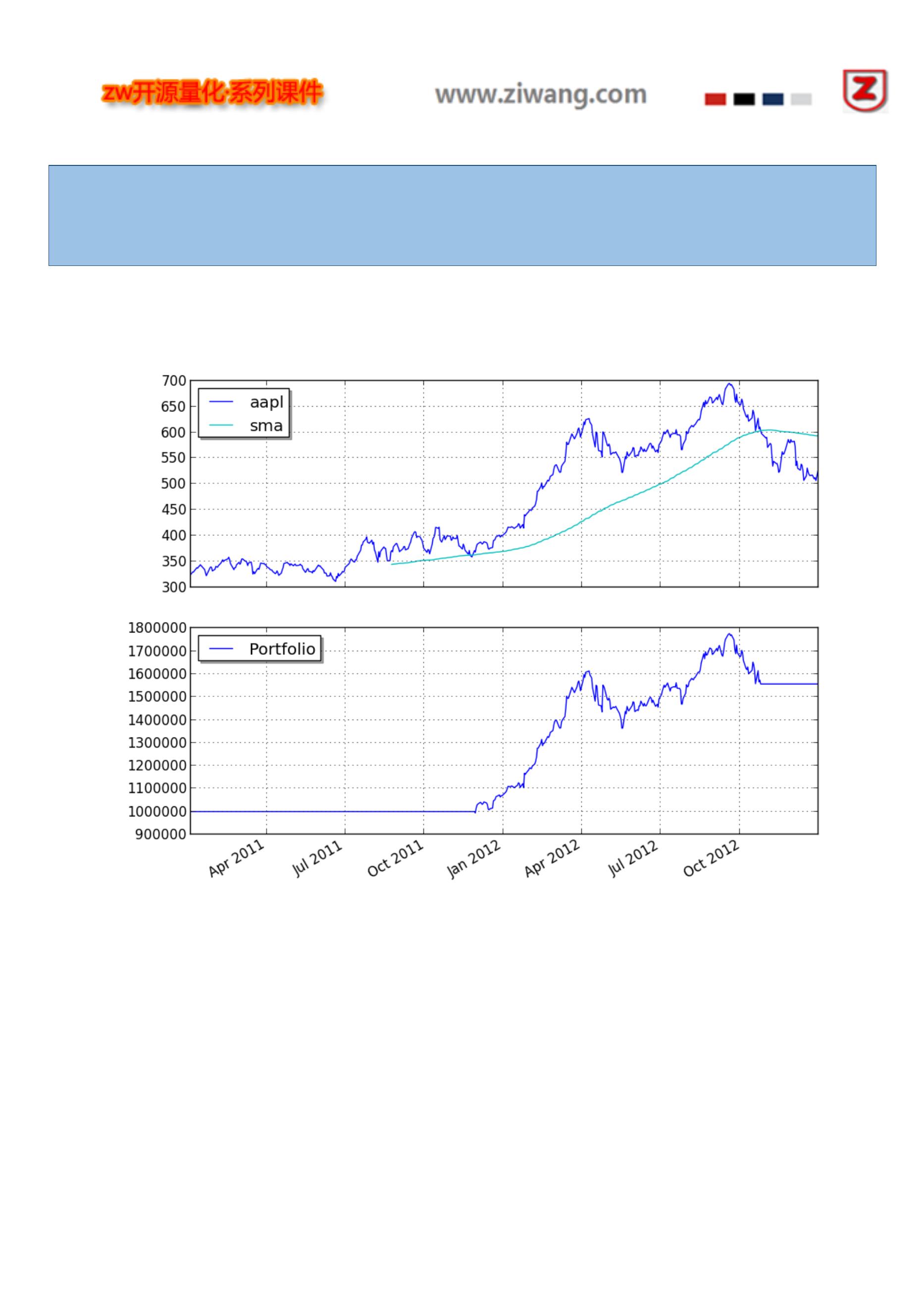

sma 简单交叉线策略 .................................................................................................................................................... 124

market_timing 市场时机策略 ....................................................................................................................................... 126

金矿策略 ........................................................................................................................................................................ 130

bbands 布林带策略 ....................................................................................................................................................... 133

rsi2 策略 ......................................................................................................................................................................... 135

quandl 策略.................................................................................................................................................................... 140

4

文档网站:http://gbeced.github.io/pyalgotrade/

PyAlgoTrade,中文意思是,python 算法交易,以下简称 PAT。

选择 PAT,作为 zw 量化培训的教材蓝本,是基于以下几个理由:

PAT 目前是一套相对完整、成熟,python 量化交易系统

水准很高,回溯系统与 zipline 一个级别

内置 TALIB 支持

虽然不支持 GPU 超算,但是内置了多节点 PC 集群的并行运算加速模式

最总要的是,支持单机离线版本。

目前,成熟的 python 量化解决方案并不多,除了 PAT 外,基本上就只有 quantopian,以及更为激进,号称无需

编程 Rizm 平台。

quantopian 的 zipline,虽然也是非常优秀量化分析算法,但是,采用的云端模式。

国内的优矿等,基本都是参考 quantopian 的云端模式

量化交易,最核心的交易策略,先天就是“闭源”(anti-open)的,许多策略,甚至是一次性。

因此,采用离线模式,是 zwQuant 最首先的考虑之一。

本文的翻译,因为时间关系,非常匆忙满,个别数据 API 章节,因为国内用户关系不大,甚至没有翻译。

请大家体谅。

5

pyAlgoTrade,是一个事件驱动的算法交易 Python 模块库,包括以下功能:

回溯测试,CSV 文件的历史数据。

模拟交易(Paper trading),参见:Xignite 教程和参考;Bitstamp 教程。

Bitstamp 比特币网站在线实盘交易。

易于使用多台计算机优化策略。

pyAlgoTrade 使用 Python2.7 开发,支持 Python3.5。

pyAlgoTrade 使用了以下 py 模块库:

numpy、scipy、pytz(时区设置)、Matplotlib、

ws4py(支持 Bitstamp)、tornado(支持 Bitstamp)

tweepy(支持推特)。

安装

你可以使用 PIP,进行安装:

pip install pyalgotrade

6

本教程,教你如何使用 PyAlgoTrade。

快速了解,股票交易策略回溯测试 backtest。

例如,你有一个股票投资想法(策略),你想使用历史数据,评估这个策略

PyAlgoTrade 让你,用最小的代价,完成这个目的。

pyalgotrade 包括以下模块:

Strategies 策略,采用的交易逻辑,以及,交易时机(什么时候买,什么时候卖),等等。

Feeds 数据源,交易数据 API。例如,你可以使用 CSV 文件,作为数据源。

Brokers 交易模块,负责执行订单。

DataSeries 数据序列,用于管理抽象的时间序列数据

Technicals 技术,这是一组过滤器,让你筛选数据 dataseries,进行计算。例如 SMA(简单移动平均)、

RSI(相对强弱指标),这些滤波器建模为 dataseries 装饰。

Optimizer 优化器,允许你测试、使用不同的电脑配置,以及多台电脑集群,便于扩展。

说到这一切,首先我们需要测试我们的策略是一些数据。

让我们使用 2000 年,Oracle 甲骨文的股票数据进行测试。

我们使用下面的命令,下载 Oracle 甲骨文的股票数据:

python -c "from pyalgotrade.tools import yahoofinance; yahoofinance.download_daily_bars('orcl', 2000, 'orcl-

2000.csv')"

pyalgotrade.tools 模块,从雅虎财经 API,下载 CSV 格式的数据。

csv 文件看起来应该像这样:

Date,Open,High,Low,Close,Volume,Adj Close

2000-12-29,30.87,31.31,28.69,29.06,31655500,28.35

2000-12-28,30.56,31.12,30.37,31.06,25055600,30.30

2000-12-27,30.37,31.06,29.37,30.69,26441700,29.94

.. .

2000-01-04,115.50,118.62,105.00,107.69,116850000,26.26

2000-01-03,124.62,125.19,111.62,118.12,98122000,28.81

让我们先从一个简单的策略开始。

第一步,只是打印收盘价看看:

7

from pyalgotrade import strategy

from pyalgotrade.barfeed import yahoofeed

【类定义】

MyStrategy(strategy.BacktestingStrategy):

def __init__(self, feed, instrument):

strategy.BacktestingStrategy.__init__(self, feed)

self.__instrument = instrument

def onBars(self, bars):

bar = bars[self.__instrument]

self.info(bar.getClose())

# Load the yahoo feed from the CSV file

feed = yahoofeed.Feed()

feed.addBarsFromCSV("orcl", "orcl-2000.csv")

# Evaluate the strategy with the feed's bars.

myStrategy = MyStrategy(feed, "orcl")

myStrategy.run()

以上代码,主要做了三件事::

定义了一个新策略(方法):onBars ,这是在 feed 数据源中,模块 bar 中要调用的子程序。

加载 feed 数据源:从 CSV 文件。

使用 feed 数据源,测试模块 bar 中,用户定义的策略:onBars

如果你成功运行这个脚本,你应该看到:收盘价格为:

2000-01-03 00:00:00 strategy [INFO] 118.12

2000-01-04 00:00:00 strategy [INFO] 107.69

2000-01-05 00:00:00 strategy [INFO] 102.0

.

.

.

2000-12-27 00:00:00 strategy [INFO] 30.69

2000-12-28 00:00:00 strategy [INFO] 31.06

2000-12-29 00:00:00 strategy [INFO] 29.06

让我们继续,这次的策略是:打印收盘价的 SMA(简单移动平均线)。

具体使用的代码技术细则,如下:

8

from pyalgotrade import strategy

from pyalgotrade.barfeed import yahoofeed

from pyalgotrade.technical import ma

【类定义】

MyStrategy(strategy.BacktestingStrategy):

def __init__(self, feed, instrument):

strategy.BacktestingStrategy.__init__(self, feed)

# We want a 15 period SMA over the closing prices.

self.__sma = ma.SMA(feed[instrument].getCloseDataSeries(), 15)

self.__instrument = instrument

def onBars(self, bars):

bar = bars[self.__instrument]

self.info("%s %s" % (bar.getClose(), self.__sma[-1]))

# Load the yahoo feed from the CSV file

feed = yahoofeed.Feed()

feed.addBarsFromCSV("orcl", "orcl-2000.csv")

# Evaluate the strategy with the feed's bars.

myStrategy = MyStrategy(feed, "orcl")

myStrategy.run()

这段代码,与前面的例子非常类似,除了:

使用收盘价数据序列(data series)前,使用了一个 SMA 过滤器,对数据进行初始化。

输出结果:是收盘价的 SMA 值。

如果你运行这个脚本,你应该可以看到,收盘价和相应的 SMA 值。

在这种案例当中,前 14 个 SMA 值是空的,因为我们需要:至少 15 个数据,来计算 SMA 值:

9

2000-01-03 00:00:00 strategy [INFO] 118.12 None

2000-01-04 00:00:00 strategy [INFO] 107.69 None

2000-01-05 00:00:00 strategy [INFO] 102.0 None

2000-01-06 00:00:00 strategy [INFO] 96.0 None

2000-01-07 00:00:00 strategy [INFO] 103.37 None

2000-01-10 00:00:00 strategy [INFO] 115.75 None

2000-01-11 00:00:00 strategy [INFO] 112.37 None

2000-01-12 00:00:00 strategy [INFO] 105.62 None

2000-01-13 00:00:00 strategy [INFO] 105.06 None

2000-01-14 00:00:00 strategy [INFO] 106.81 None

2000-01-18 00:00:00 strategy [INFO] 111.25 None

2000-01-19 00:00:00 strategy [INFO] 57.13 None

2000-01-20 00:00:00 strategy [INFO] 59.25 None

2000-01-21 00:00:00 strategy [INFO] 59.69 None

2000-01-24 00:00:00 strategy [INFO] 54.19 94.2866666667

2000-01-25 00:00:00 strategy [INFO] 56.44 90.1746666667

.

.

.

2000-12-27 00:00:00 strategy [INFO] 30.69 29.9866666667

2000-12-28 00:00:00 strategy [INFO] 31.06 30.0446666667

2000-12-29 00:00:00 strategy [INFO] 29.06 30.0946666667

当程序,无法在给定的时间内完成计算是,返回值都是:None。

一个重要的技术是,数据合并,因为这些数据,采用的都是 DataSeries 数据表格模式。

例如,简单的方法,就可以同时计算:收盘价的 SMA 值,和 RSI 值。

10

from pyalgotrade import strategy

from pyalgotrade.barfeed import yahoofeed

from pyalgotrade.technical import ma

from pyalgotrade.technical import rsi

【类定义】

MyStrategy(strategy.BacktestingStrategy):

def __init__(self, feed, instrument):

strategy.BacktestingStrategy.__init__(self, feed)

self.__rsi = rsi.RSI(feed[instrument].getCloseDataSeries(), 14)

self.__sma = ma.SMA(self.__rsi, 15)

self.__instrument = instrument

def onBars(self, bars):

bar = bars[self.__instrument]

self.info("%s %s %s" % (bar.getClose(), self.__rsi[-1], self.__sma[-1]))

# Load the yahoo feed from the CSV file

feed = yahoofeed.Feed()

feed.addBarsFromCSV("orcl", "orcl-2000.csv")

# Evaluate the strategy with the feed's bars.

myStrategy = MyStrategy(feed, "orcl")

myStrategy.run()

如果你运行这个脚本,应该在屏幕上看到一堆的数值:

前 14 个 RSI 值是空的:None,因为至少需要,15 个数值,来计算 RSI 值。

前 28 个 SMA 值是空的:None,因为前 14 个 RSI 值空的:None。

11

2000-01-03 00:00:00 strategy [INFO] 118.12 None None

2000-01-04 00:00:00 strategy [INFO] 107.69 None None

2000-01-05 00:00:00 strategy [INFO] 102.0 None None

2000-01-06 00:00:00 strategy [INFO] 96.0 None None

2000-01-07 00:00:00 strategy [INFO] 103.37 None None

2000-01-10 00:00:00 strategy [INFO] 115.75 None None

2000-01-11 00:00:00 strategy [INFO] 112.37 None None

2000-01-12 00:00:00 strategy [INFO] 105.62 None None

2000-01-13 00:00:00 strategy [INFO] 105.06 None None

2000-01-14 00:00:00 strategy [INFO] 106.81 None None

2000-01-18 00:00:00 strategy [INFO] 111.25 None None

2000-01-19 00:00:00 strategy [INFO] 57.13 None None

2000-01-20 00:00:00 strategy [INFO] 59.25 None None

2000-01-21 00:00:00 strategy [INFO] 59.69 None None

2000-01-24 00:00:00 strategy [INFO] 54.19 23.5673530141 None

2000-01-25 00:00:00 strategy [INFO] 56.44 25.0687519877 None

2000-01-26 00:00:00 strategy [INFO] 55.06 24.7476577095 None

2000-01-27 00:00:00 strategy [INFO] 51.81 23.9690136517 None

2000-01-28 00:00:00 strategy [INFO] 47.38 22.9108539956 None

2000-01-31 00:00:00 strategy [INFO] 49.95 24.980004823 None

2000-02-01 00:00:00 strategy [INFO] 54.0 28.2484181864 None

2000-02-02 00:00:00 strategy [INFO] 54.31 28.505177315 None

2000-02-03 00:00:00 strategy [INFO] 56.69 30.5596770599 None

2000-02-04 00:00:00 strategy [INFO] 57.81 31.5564353751 None

2000-02-07 00:00:00 strategy [INFO] 59.94 33.5111056589 None

2000-02-08 00:00:00 strategy [INFO] 59.56 33.3282358994 None

2000-02-09 00:00:00 strategy [INFO] 59.94 33.7177605915 None

2000-02-10 00:00:00 strategy [INFO] 62.31 36.2205441255 None

2000-02-11 00:00:00 strategy [INFO] 59.69 34.6623493641 29.0368892505

2000-02-14 00:00:00 strategy [INFO] 62.19 37.4284445543 29.9609620198

.

.

.

2000-12-27 00:00:00 strategy [INFO] 30.69 51.3196802735 49.8506368511

2000-12-28 00:00:00 strategy [INFO] 31.06 52.1646203455 49.997518354

2000-12-29 00:00:00 strategy [INFO] 29.06 47.3776678335 50.0790646925

Trading 交易

-------

12

这一次,我们用一个简单的策略,模拟一次实际的交易。

策略很简单:

如果调整收盘价,高于 SMA(15),输入多头位置(下单买进)。

如果调整收盘价,低于 SMA(15),退出多头位置(空头,下单卖出)。

13

from pyalgotrade import strategy

from pyalgotrade.barfeed import yahoofeed

from pyalgotrade.technical import ma

【类定义】

MyStrategy(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, smaPeriod):

strategy.BacktestingStrategy.__init__(self, feed, 1000)

self.__position = None

self.__instrument = instrument

# We'll use adjusted close values instead of regular close values.

self.setUseAdjustedValues(True)

self.__sma = ma.SMA(feed[instrument].getPriceDataSeries(), smaPeriod)

def onEnterOk(self, position):

execInfo = position.getEntryOrder().getExecutionInfo()

self.info("BUY at $%.2f" % (execInfo.getPrice()))

def onEnterCanceled(self, position):

self.__position = None

def onExitOk(self, position):

execInfo = position.getExitOrder().getExecutionInfo()

self.info("SELL at $%.2f" % (execInfo.getPrice()))

self.__position = None

def onExitCanceled(self, position):

# If the exit was canceled, re-submit it.

self.__position.exitMarket()

def onBars(self, bars):

# Wait for enough bars to be available to calculate a SMA.

if self.__sma[-1] is None:

return

bar = bars[self.__instrument]

# If a position was not opened, check if we should enter a long position.

if self.__position is None:

if bar.getPrice() > self.__sma[-1]:

# Enter a buy market order for 10 shares. The order is good till canceled.

self.__position = self.enterLong(self.__instrument, 10, True)

# Check if we have to exit the position.

elif bar.getPrice() < self.__sma[-1] and not self.__position.exitActive():

self.__position.exitMarket()

def run_strategy(smaPeriod):

# Load the yahoo feed from the CSV file

feed = yahoofeed.Feed()

feed.addBarsFromCSV("orcl", "orcl-2000.csv")

15

2000-01-26 00:00:00 strategy [INFO] BUY at $27.26

2000-01-28 00:00:00 strategy [INFO] SELL at $24.74

2000-02-03 00:00:00 strategy [INFO] BUY at $26.60

2000-02-22 00:00:00 strategy [INFO] SELL at $28.40

2000-02-23 00:00:00 strategy [INFO] BUY at $28.91

2000-03-31 00:00:00 strategy [INFO] SELL at $38.51

2000-04-07 00:00:00 strategy [INFO] BUY at $40.19

2000-04-12 00:00:00 strategy [INFO] SELL at $37.44

2000-04-19 00:00:00 strategy [INFO] BUY at $37.76

2000-04-20 00:00:00 strategy [INFO] SELL at $35.45

2000-04-28 00:00:00 strategy [INFO] BUY at $37.70

2000-05-05 00:00:00 strategy [INFO] SELL at $35.54

2000-05-08 00:00:00 strategy [INFO] BUY at $36.17

2000-05-09 00:00:00 strategy [INFO] SELL at $35.39

2000-05-16 00:00:00 strategy [INFO] BUY at $37.28

2000-05-19 00:00:00 strategy [INFO] SELL at $34.58

2000-05-31 00:00:00 strategy [INFO] BUY at $35.18

2000-06-23 00:00:00 strategy [INFO] SELL at $38.81

2000-06-27 00:00:00 strategy [INFO] BUY at $39.56

2000-06-28 00:00:00 strategy [INFO] SELL at $39.42

2000-06-29 00:00:00 strategy [INFO] BUY at $39.41

2000-06-30 00:00:00 strategy [INFO] SELL at $38.60

2000-07-03 00:00:00 strategy [INFO] BUY at $38.96

2000-07-05 00:00:00 strategy [INFO] SELL at $36.89

2000-07-21 00:00:00 strategy [INFO] BUY at $37.19

2000-07-24 00:00:00 strategy [INFO] SELL at $37.04

2000-07-26 00:00:00 strategy [INFO] BUY at $35.93

2000-07-28 00:00:00 strategy [INFO] SELL at $36.08

2000-08-01 00:00:00 strategy [INFO] BUY at $36.11

2000-08-02 00:00:00 strategy [INFO] SELL at $35.06

2000-08-04 00:00:00 strategy [INFO] BUY at $37.61

2000-09-11 00:00:00 strategy [INFO] SELL at $41.34

2000-09-29 00:00:00 strategy [INFO] BUY at $39.07

2000-10-02 00:00:00 strategy [INFO] SELL at $38.30

2000-10-20 00:00:00 strategy [INFO] BUY at $34.71

2000-10-31 00:00:00 strategy [INFO] SELL at $31.34

2000-11-20 00:00:00 strategy [INFO] BUY at $23.35

2000-11-21 00:00:00 strategy [INFO] SELL at $23.83

2000-12-01 00:00:00 strategy [INFO] BUY at $25.33

2000-12-21 00:00:00 strategy [INFO] SELL at $26.72

2000-12-22 00:00:00 strategy [INFO] BUY at $29.17

Final portfolio value: $979.44

16

如果我们使用 30 天 SMA(简单移动平均线),而不是 15 天 SMA,作为策略,结果会不会更好?

我们测试一下:

for i in range(10, 30):

run_strategy(i)

运行结果发现,我们使用 20 天 SMA(20)策略,获益最大:

Final portfolio value: $1075.38

(最终投资组合价值:$1075.38)

如果我们只有一组有限的参数值,这个模式不错。

但如果我们必须采用多个策略和参数,这样操作,运算难度,会随着策略变大,变得更加复杂。

Optimizing 优化

采用 optimizer 优化模块,想法很简单:

有一个服务器负责:

提供 Bar 模块,运行策略。

提供参数,运行策略。

从每次交易订单,记录策略的运行结果。

支持多个工作站(worker),同时运行。

通过服务器,运行代 bar 模块策略,以及调整参数。

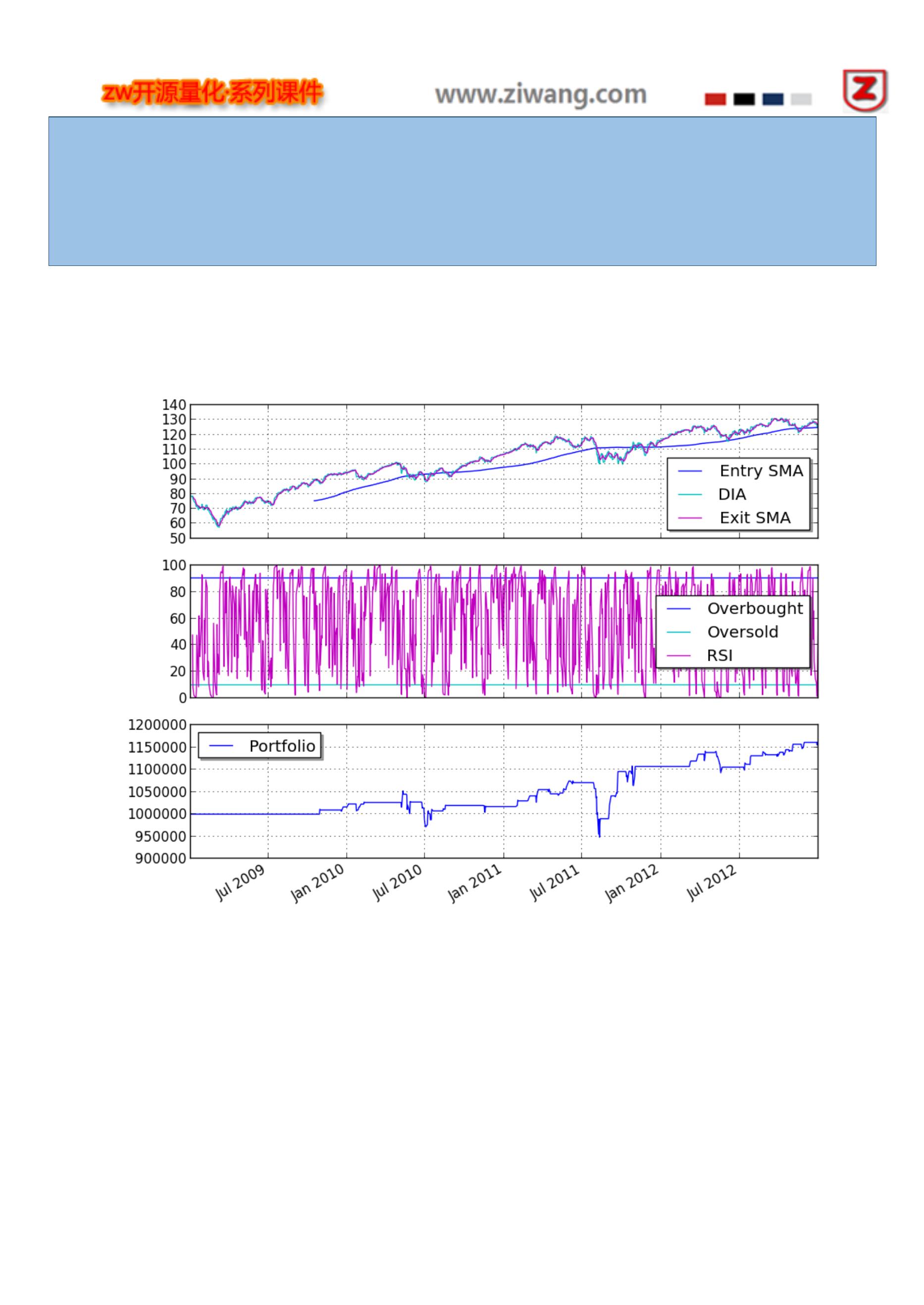

为了说明这一点,我们假设,将使用一个被称为 RSI2 的策略:

( http://stockcharts.com/school/doku.php?id=chart_school:trading_strategies:rsi2 )

RSI2 策略,需要以下参数:

识别 SMA(简单移动平均线)趋势,称之为:entrySMA,范围在:150 和 250 之间。

一小段 SMA 出口点,称之为:exitSMA,范围在:5 和 15 之间。

一个 RSI 空头/多头位置,称之为:rsiPeriod,范围在:2 和 10 之间。

RSI 多头超卖阈值,称之为:overSoldThreshold,范围在:5 到 25 之间。

RSI 空头超买阈值,称之为:overBoughtThreshold,范围在:75 和 95 之间。

如果大家的数学好,这其中有:4409559 种不同的组合。(440w)

这个策略,测试其中一组参数,花了我 0.16 秒,如果测试所有的组合的,大约需要 8.5 天,以便找到最佳的参

数设置。

这是一段很长的时间,但是,如果能找到十台 8 核电脑,来做这项工作,总时间将大约是:2.5 小时。

长话短说, 我们需要并行运算,作为解决方案。

先下载 3 年道琼斯工业平均指数,日线数据。

17

python -c "from pyalgotrade.tools import yahoofinance; yahoofinance.download_daily_bars('dia', 2009, 'dia-2009.csv')"

python -c "from pyalgotrade.tools import yahoofinance; yahoofinance.download_daily_bars('dia', 2010, 'dia-2010.csv')"

python -c "from pyalgotrade.tools import yahoofinance; yahoofinance.download_daily_bars('dia', 2011, 'dia-2011.csv')"

把以下代码,保存为 rsi2.py:

18

from pyalgotrade import strategy

from pyalgotrade.technical import ma

from pyalgotrade.technical import rsi

from pyalgotrade.technical import cross

【类定义】

RSI2(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, entrySMA, exitSMA, rsiPeriod, overBoughtThreshold, overSoldThreshold):

strategy.BacktestingStrategy.__init__(self, feed)

self.__instrument = instrument

# We'll use adjusted close values, if available, instead of regular close values.

if feed.barsHaveAdjClose():

self.setUseAdjustedValues(True)

self.__priceDS = feed[instrument].getPriceDataSeries()

self.__entrySMA = ma.SMA(self.__priceDS, entrySMA)

self.__exitSMA = ma.SMA(self.__priceDS, exitSMA)

self.__rsi = rsi.RSI(self.__priceDS, rsiPeriod)

self.__overBoughtThreshold = overBoughtThreshold

self.__overSoldThreshold = overSoldThreshold

self.__longPos = None

self.__shortPos = None

def getEntrySMA(self):

return self.__entrySMA

def getExitSMA(self):

return self.__exitSMA

def getRSI(self):

return self.__rsi

def onEnterCanceled(self, position):

if self.__longPos == position:

self.__longPos = None

elif self.__shortPos == position:

self.__shortPos = None

else:

assert(False)

def onExitOk(self, position):

if self.__longPos == position:

self.__longPos = None

elif self.__shortPos == position:

self.__shortPos = None

else:

assert(False)

def onExitCanceled(self, position):

# If the exit was canceled, re-submit it.

position.exitMarket()

文件吗:tutorial-optimizer-server.py

import itertools

from pyalgotrade.barfeed import yahoofeed

from pyalgotrade.optimizer import server

def parameters_generator():

instrument = ["dia"]

entrySMA = range(150, 251)

exitSMA = range(5, 16)

rsiPeriod = range(2, 11)

overBoughtThreshold = range(75, 96)

overSoldThreshold = range(5, 26)

return itertools.product(instrument, entrySMA, exitSMA, rsiPeriod, overBoughtThreshold, overSoldThreshold)

# The if __name__ == '__main__' part is necessary if running on Windows.

if __name__ == '__main__':

# Load the feed from the CSV files.

feed = yahoofeed.Feed()

feed.addBarsFromCSV("dia", "dia-2009.csv")

feed.addBarsFromCSV("dia", "dia-2010.csv")

feed.addBarsFromCSV("dia", "dia-2011.csv")

# Run the server.

server.serve(feed, parameters_generator(), "localhost", 5000)

以上服务器用户代码,主要做以下 3 件事:

根据策略,定义一个函数发生器,以使用不同的参数。

加载已经下载的 CSV 文件,作为 feed 数据源。

运行服务器,等待接收在端口 5000 上的连接数据。

以下工作站(worker)脚本。(文件名: tutorial-optimizer-worker.py)

使用 pyalgotrade.optimizer.worker 优化模块,并行测试运行策略,由服务器统一提供的测试数据:

20

from pyalgotrade.optimizer import worker

import rsi2

# The if __name__ == '__main__' part is necessary if running on Windows.

if __name__ == '__main__':

worker.run(rsi2.RSI2, "localhost", 5000, workerName="localworker")

当您运行服务器和客户端,你会在服务器控制台,看到这样以下信息:

2014-05-03 15:04:01,083 server [INFO] Loading bars

2014-05-03 15:04:01,348 server [INFO] Waiting for workers

2014-05-03 15:04:58,277 server [INFO] Partial result 1242173.28754 with parameters: ('dia', 150, 5, 2, 91, 19) from

localworker

2014-05-03 15:04:58,566 server [INFO] Partial result 1203266.33502 with parameters: ('dia', 150, 5, 2, 81, 19) from

localworker

2014-05-03 15:05:50,965 server [INFO] Partial result 1220763.1579 with parameters: ('dia', 150, 5, 3, 83, 24) from

localworker

2014-05-03 15:05:51,325 server [INFO] Partial result 1221627.50793 with parameters: ('dia', 150, 5, 3, 80, 24) from

localworker

.

.

同时,在工作站控制台,看到以下信息:

2014-05-03 15:02:25,360 localworker [INFO] Running strategy with parameters ('dia', 150, 5, 2, 84, 15)

2014-05-03 15:02:25,377 localworker [INFO] Running strategy with parameters ('dia', 150, 5, 2, 94, 5)

2014-05-03 15:02:25,661 localworker [INFO] Result 1090481.06342

2014-05-03 15:02:25,661 localworker [INFO] Result 1031470.23717

2014-05-03 15:02:25,662 localworker [INFO] Running strategy with parameters ('dia', 150, 5, 2, 93, 25)

2014-05-03 15:02:25,665 localworker [INFO] Running strategy with parameters ('dia', 150, 5, 2, 84, 14)

2014-05-03 15:02:25,995 localworker [INFO] Result 1135558.55667

2014-05-03 15:02:25,996 localworker [INFO] Running strategy with parameters ('dia', 150, 5, 2, 93, 24)

2014-05-03 15:02:26,006 localworker [INFO] Result 1083987.18174

2014-05-03 15:02:26,007 localworker [INFO] Running strategy with parameters ('dia', 150, 5, 2, 84, 13)

2014-05-03 15:02:26,256 localworker [INFO] Result 1093736.17175

2014-05-03 15:02:26,257 localworker [INFO] Running strategy with parameters ('dia', 150, 5, 2, 84, 12)

2014-05-03 15:02:26,280 localworker [INFO] Result 1135558.55667

.

.

请注意,应该只有一个服务器运行,以及多个工作站。

如果,你只是在自己的 PC 个人电脑,运行并行策略,你可以使用 pyalgotrade.optimizer.local 模块。

代码如下:

21

from pyalgotrade.optimizer import local

from pyalgotrade.barfeed import yahoofeed

import rsi2

def parameters_generator():

instrument = ["dia"]

entrySMA = range(150, 251)

exitSMA = range(5, 16)

rsiPeriod = range(2, 11)

overBoughtThreshold = range(75, 96)

overSoldThreshold = range(5, 26)

return itertools.product(instrument, entrySMA, exitSMA, rsiPeriod, overBoughtThreshold, overSoldThreshold)

# The if __name__ == '__main__' part is necessary if running on Windows.

if __name__ == '__main__':

# Load the feed from the CSV files.

feed = yahoofeed.Feed()

feed.addBarsFromCSV("dia", "dia-2009.csv")

feed.addBarsFromCSV("dia", "dia-2010.csv")

feed.addBarsFromCSV("dia", "dia-2011.csv")

local.run(rsi2.RSI2, feed, parameters_generator())

这段代码,主要做 3 件事:

根据策略,定义一个函数发生器,以使用不同的参数。

加载已经下载的 CSV 文件,作为 feed 数据源。

使用 pyalgotrade.optimizer.local 模块,并行运行策略,以找到最佳结果。

当您运行这个代码,您应当会看到,类似下面的信息:

22

2014-05-03 15:08:06,587 server [INFO] Loading bars

2014-05-03 15:08:06,910 server [INFO] Waiting for workers

2014-05-03 15:08:58,347 server [INFO] Partial result 1242173.28754 with parameters: ('dia', 150, 5, 2, 91, 19) from

worker-95583

2014-05-03 15:08:58,967 server [INFO] Partial result 1203266.33502 with parameters: ('dia', 150, 5, 2, 81, 19) from

worker-95584

2014-05-03 15:09:52,097 server [INFO] Partial result 1220763.1579 with parameters: ('dia', 150, 5, 3, 83, 24) from

worker-95584

2014-05-03 15:09:52,921 server [INFO] Partial result 1221627.50793 with parameters: ('dia', 150, 5, 3, 80, 24) from

worker-95583

2014-05-03 15:10:40,826 server [INFO] Partial result 1142162.23912 with parameters: ('dia', 150, 5, 4, 76, 17) from

worker-95584

2014-05-03 15:10:41,318 server [INFO] Partial result 1107487.03214 with parameters: ('dia', 150, 5, 4, 83, 17) from

worker-95583

.

根据运算结果记录,最佳值是:2314.40 美元

采用以下参数组合:

entrySMA:154

exitSMA:5

rsiPeriod:2

overBoughtThreshold:91

overSoldThreshold:18

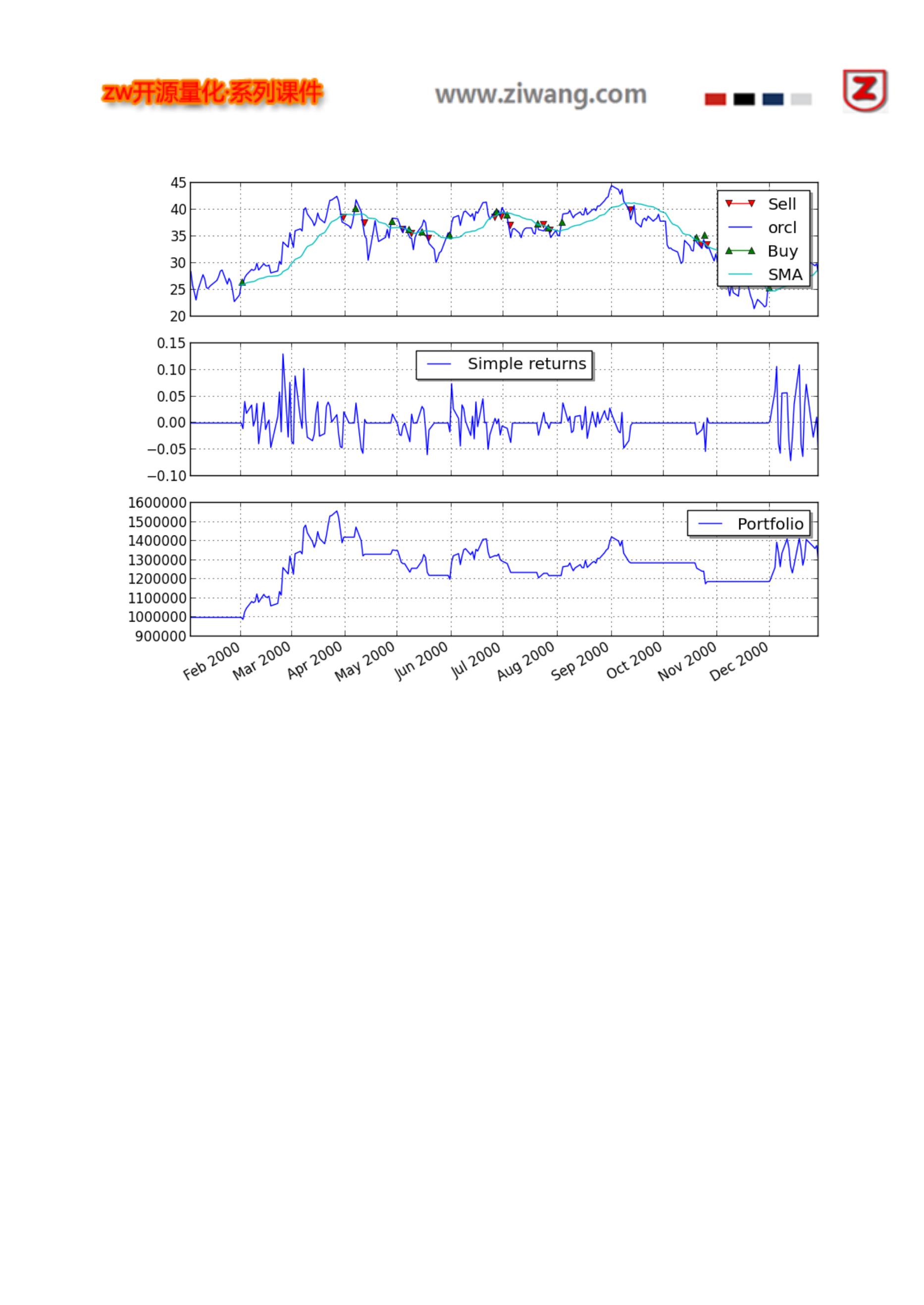

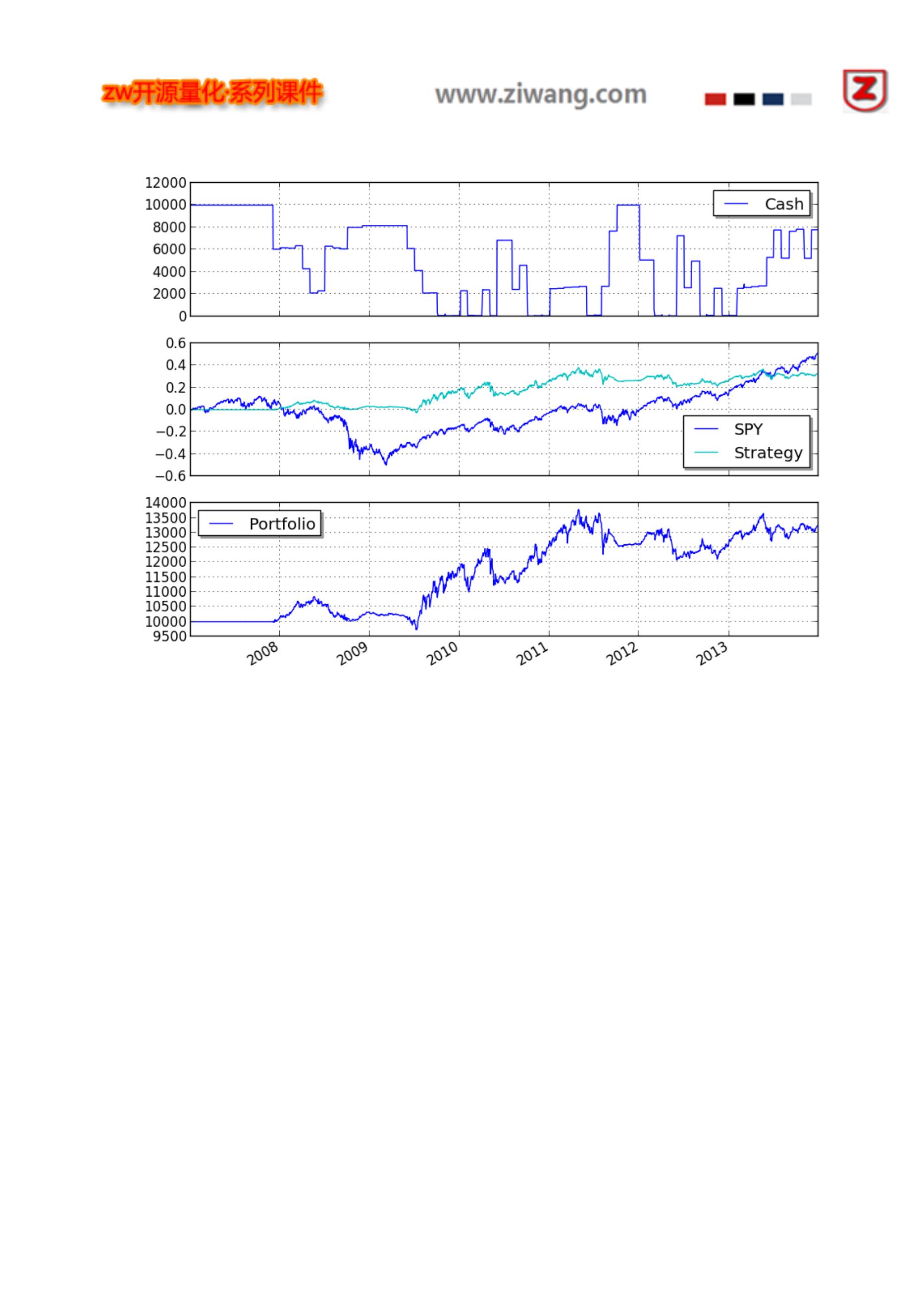

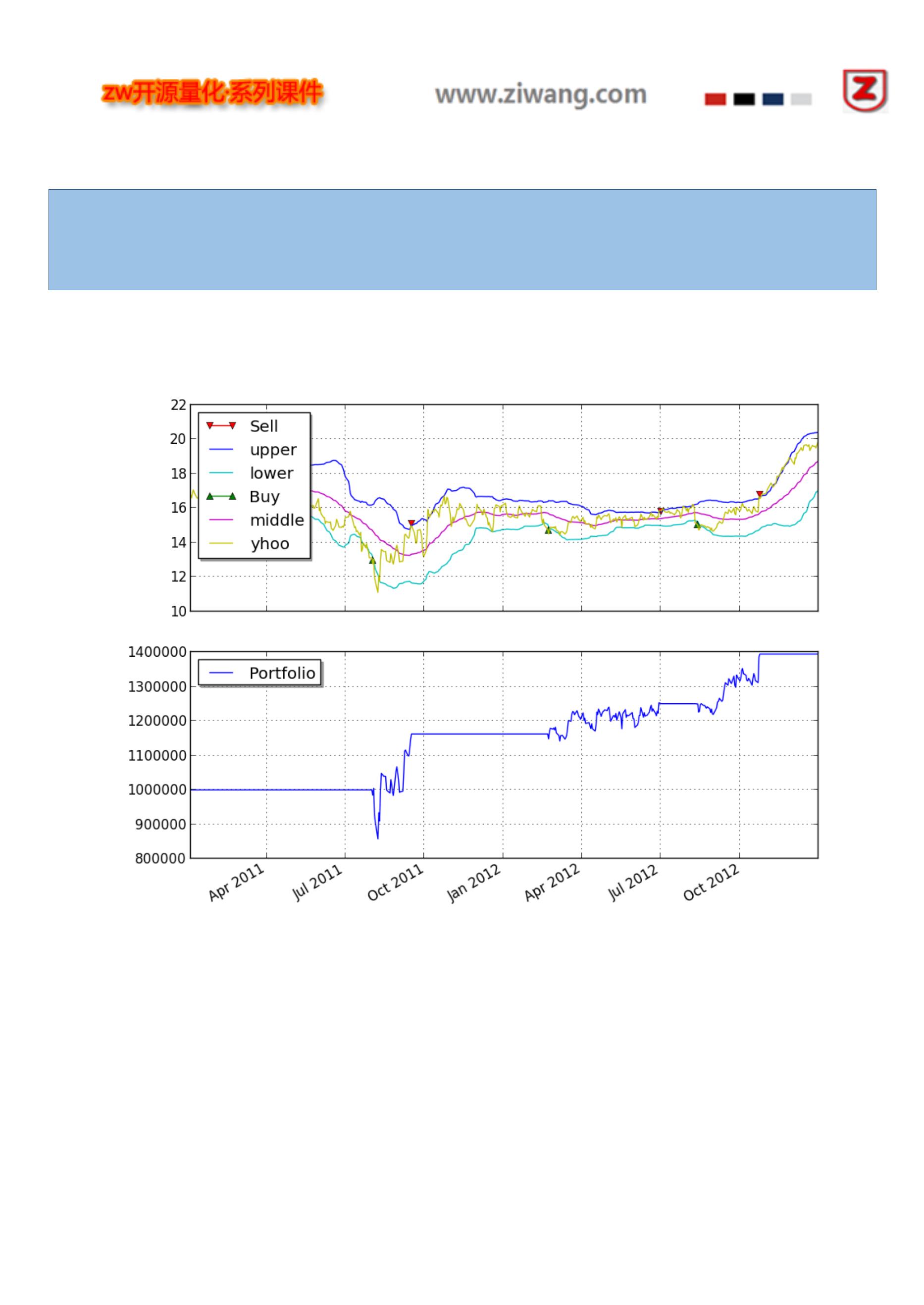

Plotting 绘图

PyAlgoTrade 的设计,使得策略绘图,很容易操作:

保存以下代码:(文件名:sma_crossover.py)

23

from pyalgotrade import strategy

from pyalgotrade.technical import ma

from pyalgotrade.technical import cross

【类定义】

SMACrossOver(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, smaPeriod):

strategy.BacktestingStrategy.__init__(self, feed)

self.__instrument = instrument

self.__position = None

# We'll use adjusted close values instead of regular close values.

self.setUseAdjustedValues(True)

self.__prices = feed[instrument].getPriceDataSeries()

self.__sma = ma.SMA(self.__prices, smaPeriod)

def getSMA(self):

return self.__sma

def onEnterCanceled(self, position):

self.__position = None

def onExitOk(self, position):

self.__position = None

def onExitCanceled(self, position):

# If the exit was canceled, re-submit it.

self.__position.exitMarket()

def onBars(self, bars):

# If a position was not opened, check if we should enter a long position.

if self.__position is None:

if cross.cross_above(self.__prices, self.__sma) > 0:

shares = int(self.getBroker().getCash() * 0.9 / bars[self.__instrument].getPrice())

# Enter a buy market order. The order is good till canceled.

self.__position = self.enterLong(self.__instrument, shares, True)

# Check if we have to exit the position.

elif not self.__position.exitActive() and cross.cross_below(self.__prices, self.__sma) > 0:

self.__position.exitMarket()

以下代码,保存到另一个文件:(tutorial-5.py)

24

from pyalgotrade import plotter

from pyalgotrade.barfeed import yahoofeed

from pyalgotrade.stratanalyzer import returns

import sma_crossover

# Load the yahoo feed from the CSV file

feed = yahoofeed.Feed()

feed.addBarsFromCSV("orcl", "orcl-2000.csv")

# Evaluate the strategy with the feed's bars.

myStrategy = sma_crossover.SMACrossOver(feed, "orcl", 20)

# Attach a returns analyzers to the strategy.

returnsAnalyzer = returns.Returns()

myStrategy.attachAnalyzer(returnsAnalyzer)

# Attach the plotter to the strategy.

plt = plotter.StrategyPlotter(myStrategy)

# Include the SMA in the instrument's subplot to get it displayed along with the closing prices.

plt.getInstrumentSubplot("orcl").addDataSeries("SMA", myStrategy.getSMA())

# Plot the simple returns on each bar.

plt.getOrCreateSubplot("returns").addDataSeries("Simple returns", returnsAnalyzer.getReturns())

# Run the strategy.

myStrategy.run()

myStrategy.info("Final portfolio value: $%.2f" % myStrategy.getResult())

# Plot the strategy.

plt.plot()

以上代码,主要做 3 件事:

从 CSV 文件加载数据源。

利用数据源,StrategyPlotter 策略绘图模块,运行 bar 策略

绘制策略运行图表。

运行结果如下:

25

建议大家下载 PyAlgoTrade: http://gbeced.github.io/pyalgotrade/downloads/index.html

开始编写自己的交易策略。

你还可以,找到在网站,找到更多演示例子。

26

Documentation for the code

==========================

Contents:

.. toctree::

:maxdepth: 2

bar

dataseries

feed

barfeed

technical

broker

strategy

stratanalyzer

plotter

optimizer

marketsession

Documentation for the code

==========================

Contents:

.. toctree::

:maxdepth: 2

bar

dataseries

feed

barfeed

technical

broker

strategy

stratanalyzer

plotter

optimizer

marketsession

bar,k 线数据包

27

【类定义】

pyalgotrade.bar.Frequency(k 线频率)

基类 Bases: object

类似枚举 Enum 的 bar 的频率值,有效值是:

Frequency.TRADE::按单计算的交易频率

Frequency.SECOND:一秒内的交易频率

Frequency.MINUTE:一分钟的交易频率

Frequency.HOUR:一小时的交易频率

Frequency.DAY:一天的交易频率

Frequency.WEEK:一周的交易频率

Frequency.MONTH: The bar summarizes the trading activity during 1 month.

【类定义】

pyalgotrade.bar.Bar

基类 Bases: object

Bar,k 线数据包,是一个指定时期的有效交易数据总集。

【注意】

这是一个基础类定义,不要直接使用

__metaclass__:ABCMeta 的别名。

getDateTime(),返回值:日期

getOpen(adjusted=False),返回值:开盘价

getHigh(adjusted=False),返回值:最高价

getLow(adjusted=False),返回值:最低价

getClose(adjusted=False),返回值:收盘价

getVolume(),返回值:成交量 volume.

getAdjClose(),返回值:调整收盘价 getFrequency(),bar 的时间长度.

getTypicalPrice(),返回值:典型价格 typical price.

getPrice(),返回值:收盘价或者调整收盘价

【类定义】

pyalgotrade.bar.Bars(barDict)

基类 Bases: object

一组 Bar 对象.

28

barDict (map.) –Bar 对象的数据 map 映像.

【注意】

所有的 bars 必须使用同样的时间

__getitem__(instrument),返回值:给定参数的 Bar 值,如果为空,会抛出异常。

__contains__(instrument),返回值:True,如果给定参数的 bar 数据集有效.

getInstruments(),返回值:参数符号

getDateTime(),返回值:bar,k 线数据的时间

getBar(instrument),返回值:给定参数的 Bar 值,如果为空,返回值是:None

dataseries 数据序列

dataseries – 基础数据类型。

======================================

数据序列(Data series),用于管理:抽象的时间序列数据。

【类定义】

pyalgotrade.dataseries.DataSeries

基类 Bases: object,数据序列基础类。

【注意】

这是一个基础类定义,不要直接使用

__getitem__(key),返回值:key 对应的值,如果返回值无效,会引发错误:IndexError;如果分会会长类型不对,

会引发错误:TypeError。

__len__(),返回值:对数据序列中的元素的个数。

__metaclass__:ABCMeta 的别名。

getDateTimes(),返回值:一个和数值对应的时间列。

【类定义】

pyalgotrade.dataseries.SequenceDataSeries(maxLen=1024)

基类 Bases: pyalgotrade.dataseries.DataSeries

DataSeries 是保存在内存中的数据序列。

【参数】

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

append(value),增加一个值。

appendWithDateTime(dateTime, value),根据关联的 datetime,增加一个值

29

如果没有对于的 dateTime,它必须大于最后一个。

getMaxLen(),返回值:返回数值的最大数量

setMaxLen(maxLen),设置数值的最大数量,必要时,调整相应大小。

pyalgotrade.dataseries.aligned.datetime_aligned(ds1, ds2, maxLen=1024)

返回值:two dataseries that exhibit only those values whose datetimes are in both dataseries.

【参数】

ds1 (DataSeries.) ,DataSeries 实例。

ds2 (DataSeries.) ,DataSeries 实例。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

【类定义】

pyalgotrade.dataseries.bards.BarDataSeries(maxLen=1024)

基类 Bases: pyalgotrade.dataseries.SequenceDataSeries

pyalgotrade.bar.Bar 的数据序列实例。

【参数】

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

getAdjCloseDataSeries(),返回值:调整后的收盘价数据序列。

getCloseDataSeries(),返回值:收盘价数据序列。

getHighDataSeries(),返回值:最高价数据序列。

getLowDataSeries(),返回值:最低价数据序列。

getOpenDataSeries(),返回值:开盘价数据序列。

getPriceDataSeries(),返回值:收盘价数据序列,或者,调整后的收盘价数据序列。

getVolumeDataSeries(),返回值:成交量数据序列。

【类定义】

pyalgotrade.dataseries.resampled.ResampledBarDataSeries(dataSeries, frequency, maxLen=1024)

基类 Bases: pyalgotrade.dataseries.bards.BarDataSeries, pyalgotrade.dataseries.resampled.DSResampler

BarDataSeries 将以更高的频率,对参考 BarDataSeries 重新采样。

【参数】

dataSeries (pyalgotrade.dataseries.bards.BarDataSeries),被重新取样的 DataSeries 实例。

frequency,每秒分组频率,必须>0

maxLen (int.) ,数值的最大数量。当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

30

支持重采样的频率是:

小于 bar.Frequency.DAY

bar.Frequency.DAY

bar.Frequency.MONTH

checkNow(dateTime),强行重新取样检查。根据重新取样频率,和当前日期时间,一个新的数值可能会生成。

【参数】

dateTime (datetime.datetime) ,当前日期时间。

31

feed 数据源,是时间序列数据的抽象。

当这些数据源,在事件调度循环当中,他们根据事件,生成一个可用的新数据是,并且负责更新。

pyalgotrade.dataseries.DataSeries 模块,负责提供数据源,以及相关数据的更新。

这个模块包,包括基本的数据源。

bar,k 线数据包模块,负责提供:barfeed 部分的数据源。

【类定义】

pyalgotrade.feed.BaseFeed(maxLen)

基类 Bases: pyalgotrade.observer.Subject

【参数】

maxLen (int.) , 最大数量,当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

【注意】

这是一个基础类定义,不要直接使用

__contains__(key),返回值:True,返回 True,如果返回值是可用的。

__getitem__(key),返回值:返回关键字,对应的数值。

getNewValuesEvent(),返回值:返回事件,当新值可用时。需要传递两个参数:

一个时间值。

新值。

CSV 支持

【类定义】

pyalgotrade.feed.csvfeed.Feed(dateTimeColumn, dateTimeFormat, converter=None, delimiter=', ', timezone=None,

maxLen=1024)

基类 Bases: pyalgotrade.feed.csvfeed.BaseFeed

提要从 CSV 格式的文件加载数据源。

【参数】

dateTimeColumn (string.) ,时间序列的名称信息。

dateTimeFormat (string.),时间格式

converter (function.), 转换函数,变量是函数

delimiter (string.),分隔符

timezone (A pytz timezone.),时区

maxLen (int.),数据序列最大长度,当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

32

addValuesFromCSV(path),从 csv 文件加载数据。

【参数】

path (string.),CSV 文件路径名。

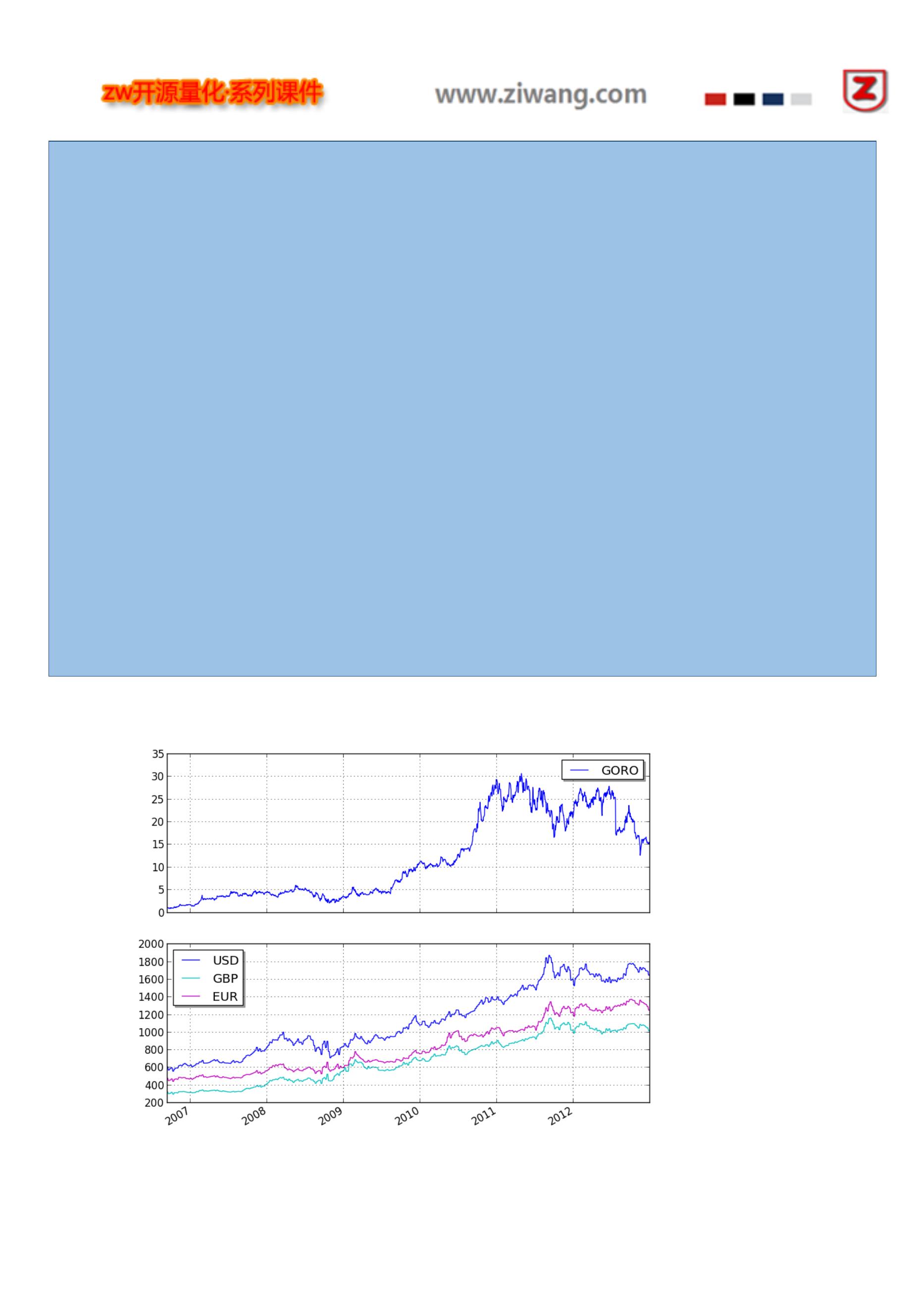

【CSV 文件示例】

一个 csv 文件,采用以下格式:

Date,USD,GBP,EUR

2013-09-29,1333.0,831.203,986.75

2013-09-22,1349.25,842.755,997.671

2013-09-15,1318.5,831.546,993.969

2013-09-08,1387.0,886.885,1052.911

......

.

代码如下:

from pyalgotrade.feed import csvfeed

feed = csvfeed.Feed("Date", "%Y-%m-%d")

feed.addValuesFromCSV("quandl_gold_2.csv")

for dateTime, value in feed:

print dateTime, value

运行结果,类似如下:

33

1968-04-07 00:00:00 {'USD': 37.0, 'GBP': 15.3875, 'EUR': ''}

1968-04-14 00:00:00 {'USD': 38.0, 'GBP': 15.8208, 'EUR': ''}

1968-04-21 00:00:00 {'USD': 37.65, 'GBP': 15.6833, 'EUR': ''}

1968-04-28 00:00:00 {'USD': 38.65, 'GBP': 16.1271, 'EUR': ''}

1968-05-05 00:00:00 {'USD': 39.1, 'GBP': 16.3188, 'EUR': ''}

1968-05-12 00:00:00 {'USD': 39.6, 'GBP': 16.5625, 'EUR': ''}

1968-05-19 00:00:00 {'USD': 41.5, 'GBP': 17.3958, 'EUR': ''}

1968-05-26 00:00:00 {'USD': 41.75, 'GBP': 17.5104, 'EUR': ''}

1968-06-02 00:00:00 {'USD': 41.95, 'GBP': 17.6, 'EUR': ''}

1968-06-09 00:00:00 {'USD': 41.25, 'GBP': 17.3042, 'EUR': ''}

.

.

.

2013-07-28 00:00:00 {'USD': 1331.0, 'GBP': 864.23, 'EUR': 1001.505}

2013-08-04 00:00:00 {'USD': 1309.25, 'GBP': 858.637, 'EUR': 986.921}

2013-08-11 00:00:00 {'USD': 1309.0, 'GBP': 843.156, 'EUR': 979.79}

2013-08-18 00:00:00 {'USD': 1369.25, 'GBP': 875.424, 'EUR': 1024.964}

2013-08-25 00:00:00 {'USD': 1377.5, 'GBP': 885.738, 'EUR': 1030.6}

2013-09-01 00:00:00 {'USD': 1394.75, 'GBP': 901.292, 'EUR': 1055.749}

2013-09-08 00:00:00 {'USD': 1387.0, 'GBP': 886.885, 'EUR': 1052.911}

2013-09-15 00:00:00 {'USD': 1318.5, 'GBP': 831.546, 'EUR': 993.969}

2013-09-22 00:00:00 {'USD': 1349.25, 'GBP': 842.755, 'EUR': 997.671}

2013-09-29 00:00:00 {'USD': 1333.0, 'GBP': 831.203, 'EUR': 986.75}

barfeed,k 线数据

【类定义】

pyalgotrade.barfeed.BaseBarFeed(frequency, maxLen=1024)

基类 Bases: pyalgotrade.feed.BaseFeed

提供提要 Bar,k 线数据源。

【参数】

frequency – bars 数据包频率,有效参数,参见:pyalgotrade.bar.Frequency.

maxLen (int.),最大序列长度,当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

【注意】

这是一个基础类定义,不要直接使用

getNextBars(),返回下一个 Bar 数据包,会覆盖旧值。

34

这是 BaseBarFeed 的子类,不要直接调用。

getCurrentBars(),返回值:当前的 Bar 数据包。

getLastBar(instrument),返回值:最后一个 Bar 数据包。

getDefaultInstrument(),返回值:默认的 Bar 数据工具。

getRegisteredInstruments(),返回值:注册的 Bar 数据工具名称列表。

getDataSeries(instrument=None),返回值:指定的数据序列。

【参数】

instrument (string.),Bar 数据工具 ID,如果是:None,返回默认值。

返回值类型,参见: pyalgotrade.dataseries.bards.BarDataSeries.

CSV 数据文件

【类定义】

pyalgotrade.barfeed.csvfeed.BarFeed(frequency, maxLen=1024)

基类 Bases: pyalgotrade.barfeed.membf.BarFeed

【注意】

这是一个基础类定义,不要直接使用

【类定义】

pyalgotrade.barfeed.csvfeed.GenericBarFeed(frequency, timezone=None, maxLen=1024)

基类 Bases: pyalgotrade.barfeed.csvfeed.BarFeed

BarFeed,从 CSV 文件,加载数据源,形式如下:

Date Time,Open,High,Low,Close,Volume,Adj Close

2013-01-01 13:59:00,13.51001,13.56,13.51,13.56,273.88014126,13.51001

【参数】

frequency ,bars 数据包的频率,参见:pyalgotrade.bar.Frequency.

timezone (A pytz timezone.) ,时区,默认使用本地时区。

maxLen (int.) ,最大序列长度,当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

35

CSV 文件,第一行必须是列名称。

调整收盘价为空白,属于正常情况

当使用多个数据采集工具时:

如果所有数据采集工具,使用同一个时区,可以不特别指定,时区参数、

如果使用不同时区,必须设置对应的时区参数

addBarsFromCSV(instrument, path, timezone=None)

从 csv 文件,加载 bar 数据包。

【参数】

instrument (string.) ,数据工具|ID。

path (string.),CSV 文件的路径名。

timezone (A pytz timezone.) ,时区。

Yahoo! Finance 雅虎金融

【类定义】

pyalgotrade.barfeed.yahoofeed.Feed(frequency=86400, timezone=None, maxLen=1024)

基类 Bases: pyalgotrade.barfeed.csvfeed.BarFeed

从雅虎金融网站下载的 CSV 文件,加载 bar 数据源。

【参数】

frequency ,bars 数据包的频率,只支持:日、周两种频率。

(pyalgotrade.bar.Frequency.DAY, pyalgotrade.bar.Frequency.WEEK)

timezone (A pytz timezone.),时区

maxLen (int.) ,最大序列长度,当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

【注意】

雅虎金融 csv 文件缺乏时区信息。

当使用多个数据采集工具时:

如果所有工具在同一个时区,可以不指定时区参数。如果工具在不同时区,必须设置时区参数

addBarsFromCSV(instrument, path, timezone=None)

从 csv 文件,加载 bar 数据包。

【参数】

instrument (string.) ,数据工具|ID。

36

timezone (A pytz timezone.) ,时区。

Google Finance 谷歌金融

【类定义】

pyalgotrade.barfeed.googlefeed.Feed(frequency=86400, timezone=None, maxLen=1024)

基类 Bases: pyalgotrade.barfeed.csvfeed.BarFeed

从谷歌金融网站下载的 CSV 文件,加载 bar 数据源。

【参数】

frequency,bars 数据包的频率,只支持:日频率。

(pyalgotrade.bar.Frequency.DAY)

timezone (A pytz timezone.),时区

maxLen (int.) ,最大序列长度,当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

【注意】

谷歌金融 csv 文件缺乏时区信息。

当使用多个数据采集工具时:

如果所有工具在同一个时区,可以不指定时区参数。如果工具在不同时区,必须设置时区参数

addBarsFromCSV(instrument, path, timezone=None)

从 csv 文件,加载 bar 数据包。

【参数】

instrument (string.) ,数据工具|ID。

path (string.),CSV 文件的路径名。

timezone (A pytz timezone.) ,时区。

Quandl 数据

【类定义】

pyalgotrade.barfeed.quandlfeed.Feed(frequency=86400, timezone=None, maxLen=1024)

基类 Bases: pyalgotrade.barfeed.csvfeed.GenericBarFeed

从 Quandl 下载的 CSV 文件,加载 bar 数据源。

37

frequency ,bars 数据包的频率,只支持:日、周两种频率。

(pyalgotrade.bar.Frequency.DAY, pyalgotrade.bar.Frequency.WEEK)

timezone (A pytz timezone.),时区

maxLen (int.) ,最大序列长度,当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

【注意】

当使用多个数据采集工具时:

如果所有工具在同一个时区,可以不指定时区参数。如果工具在不同时区,必须设置时区参数

NinjaTrader 数据 (忍者交易员)

【类定义】

pyalgotrade.barfeed.ninjatraderfeed.Feed(frequency, timezone=None, maxLen=1024)

基类 Bases: pyalgotrade.barfeed.csvfeed.BarFeed

从 NinjaTrader 下载的 CSV 文件,加载 bar 数据源。

【参数】

frequency ,bars 数据包的频率,只支持:日、分钟两种频率。

(pyalgotrade.bar.Frequency.DAY, pyalgotrade.bar.Frequency.MINUTE)

timezone (A pytz timezone.),时区

maxLen (int.) ,最大序列长度,当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

addBarsFromCSV(instrument, path, timezone=None)

从 csv 文件,加载 bar 数据包。

【参数】

instrument (string.) ,数据工具|ID。

path (string.),CSV 文件的路径名。

timezone (A pytz timezone.) ,时区。

technical 技术指标

【类定义】

38

pyalgotrade.technical.EventWindow(windowSize, dtype=<type 'float'>, skipNone=True)

基类 Bases: object

一个 EventWindow 类,负责移动窗口,使计算相关的数值。

【参数】

windowSize (int.) ,窗口的大小。 必须大于 0

dtype (data-type.) ,数组的数据类型。

skipNone (boolean.) ,值为 True 时,如果数值为空:None,就不应包含在窗口内。

【注意】

这是一个基础类定义,不要直接使用

getValue(),使用窗口中的值,覆盖计算值。

getValues(),返回值:返回一个 numpy, 窗口中的数组值。

getWindowSize(),返回值:返回窗口大小。

【类定义】

pyalgotrade.technical.EventBasedFilter(dataSeries, eventWindow, maxLen=1024)

基类 Bases: pyalgotrade.dataseries.SequenceDataSeries

EventBasedFilter 类负责获取新值 ,并使用 EventWindow 计算新值。

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

eventWindow (EventWindow.) ,EventWindow 实例,计算新值。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

过滤示例

下面例子,说明如何结合 EventWindow 和 EventBasedFilter,构建一个自定义的过滤器:

39

from pyalgotrade import dataseries

from pyalgotrade import technical

# An EventWindow is responsible for making calculations using a window of values.

class Accumulator(technical.EventWindow):

def getValue(self):

ret = None

if self.windowFull():

ret = self.getValues().sum()

return ret

# Build a sequence based DataSeries.

seqDS = dataseries.SequenceDataSeries()

# Wrap it with a filter that will get fed as new values get added to the underlying DataSeries.

accum = technical.EventBasedFilter(seqDS, Accumulator(3))

# Put in some values.

for i in range(0, 50):

seqDS.append(i)

# Get some values.

print accum[0] # Not enough values yet.

print accum[1] # Not enough values yet.

print accum[2] # Ok, now we should have at least 3 values.

print accum[3]

# Get the last value, which should be equal to 49 + 48 + 47.

print accum[-1]

输出应该是:

None

None

3.0

6.0

144.0

40

简单移动平均线过滤

【类定义】

pyalgotrade.technical.ma.SMA(dataSeries, period, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

period (int.),时间段,用于计算 SMA。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

指数移动平均过滤

【类定义】

pyalgotrade.technical.ma.EMA(dataSeries, period, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

period (int.) ,时间段,用于计算 EMA,必须>1。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

加权移动平均线过滤

【类定义】

pyalgotrade.technical.ma.WMA(dataSeries, weights, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

41

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

成交量加权平均价格过滤。

【类定义】

pyalgotrade.technical.vwap.VWAP(dataSeries, period, useTypicalPrice=False, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

dataSeries (pyalgotrade.dataseries.bards.BarDataSeries.) ,被过滤的 DataSeries 实例。

period (int.) ,时间段,用于计算 V WAP.

useTypicalPrice (boolean.) – True if the typical price should be used instead of the closing price.

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

动量指标过滤

MACD 指数平滑移动平均线

【类定义】

pyalgotrade.technical.macd.MACD(dataSeries, fastEMA, slowEMA, signalEMA, maxLen=1024)

基类 Bases: pyalgotrade.dataseries.SequenceDataSeries

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

fastEMA (int.) ,数目,用于计算快速 EMA.

slowEMA (int.) ,数目,用于计算慢速 EMA.

signalEMA (int.) ,数目,用于计算信号 EMA

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

getHistogram(),返回值:直方图 (MACD 和信号数据的差值.

getSignal(),返回值:计算 MACD 的 EMA 数据序列。

42

【类定义】

pyalgotrade.technical.rsi.RSI(dataSeries, period, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

period (int.),时间段。如果 period 值是 n,n+1 个值必须> 1.

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

KD 随机震荡指标 Stochastic Oscillator

【类定义】

pyalgotrade.technical.stoch.StochasticOscillator(barDataSeries, period, dSMAPeriod=3, useAdjustedValues=False,

maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【注意】

这个过滤器,所返回的值是% K,需使用 getD()函数,访问% D

【参数】

barDataSeries (pyalgotrade.dataseries.bards.BarDataSeries.) ,被过滤的 DataSeries 实例。

period (int.) ,时间段,必须> 1.

dSMAPeriod (int.),–%D SMA,时间段,必须> 1.

useAdjustedValues (boolean.),为 True,使用调整后的 ow/High/Close 价格

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

getD(),返回值:返回一个 % D 值

变动率

【类定义】

pyalgotrade.technical.roc.RateOfChange(dataSeries, valuesAgo, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

43

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

valuesAgo (int.) ,比较值的数目,必须> 0。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

其他技术指标

ATR 平均真实波幅

【类定义】

pyalgotrade.technical.atr.ATR(barDataSeries, period, useAdjustedValues=False, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

barDataSeries (pyalgotrade.dataseries.bards.BarDataSeries.) ,被过滤的 DataSeries 实例。

period (int.) ,平均时间段,必须> 1.

useAdjustedValues (boolean.),为 True,使用调整后的 ow/High/Close 价格

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

布林带

【类定义】

pyalgotrade.technical.bollinger.BollingerBands(dataSeries, period, numStdDev, maxLen=1024)

基类 Bases: object

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

period (int.) ,需计算的数值数目,必须> 1.

numStdDev (int.),标准差的数量,上、下带区使用。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

getLowerBand(),返回值:低位线的数据序列

getMiddleBand(),返回值:中位线的数据序列

getUpperBand(),返回值:高位线的数据序列

44

pyalgotrade.technical.cross.cross_above(values1, values2, start=-2, end=None)

检查指定的时期、条件下,两个 DataSeries 对象之间的高位交叉区。

【参数】

values1 (pyalgotrade.dataseries.DataSeries.),交叉数据序列。

values2 (pyalgotrade.dataseries.DataSeries.) ,被交叉数据序列。

start (int.) ,范围的开始。

end (int.) ,范围的结束。

【注意】

默认的起始和结束值,使用最后 2 个数值,检查上面交叉条件。

pyalgotrade.technical.cross.cross_below(values1, values2, start=-2, end=None)

检查指定的时期、条件下,两个 DataSeries 对象之间的低位交叉区。

【参数】

values1 (pyalgotrade.dataseries.DataSeries.),交叉数据序列。

values2 (pyalgotrade.dataseries.DataSeries.) ,被交叉数据序列。

start (int.) ,范围的开始。

end (int.) ,范围的结束。

【注意】

默认的起始和结束值,使用最后 2 个数值,检查上面交叉条件。

累计收益率

【类定义】

pyalgotrade.technical.cumret.CumulativeReturn(dataSeries, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

最高价值

【类定义】

pyalgotrade.technical.highlow.High(dataSeries, period, maxLen=1024)

45

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

period (int.) ,需计算的数值数目。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

最低价值

【类定义】

pyalgotrade.technical.highlow.Low(dataSeries, period, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

period (int.) ,需计算的数值数目。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

赫斯特指数

【类定义】

pyalgotrade.technical.hurst.HurstExponent(dataSeries, period, minLags=2, maxLags=20, logValues=True,

maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

period (int.) ,需计算的数值数目。

minLags (int.) ,最小滞后数量, 必须> = 2

maxLags (int.) ,最大滞后数量, 必须> minLags 2

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

突破线

【类定义】

pyalgotrade.technical.linebreak.Line(low, high, dateTime, white)

46

getDateTime(),时间

getHigh(),最高价

getLow(),最低价

isBlack(),如果是 True,表示黑色(价格下跌)。

isWhite(),如果是 True,表示白色(价格上升)。

三线突破

【类定义】

pyalgotrade.technical.linebreak.LineBreak(barDataSeries, reversalLines, useAdjustedValues=False, maxLen=1024)

基类 Bases: pyalgotrade.dataseries.SequenceDataSeries

【参数】

barDataSeries (pyalgotrade.dataseries.bards.BarDataSeries.) ,被过滤的 DataSeries 实例。

reversalLines (int.) ,计算回转的线的数目,必须>1

useAdjustedValues (boolean.) ,为 True,使用调整后的 ow/High/Close 价格

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。这

个值不能小于 reversalLines。

最小二次回归

【类定义】

pyalgotrade.technical.linreg.LeastSquaresRegression(dataSeries, windowSize, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

windowSize (int.) ,需计算的数值数目。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

getValueAt(dateTime),基于二次回归,计算给定时间点的数据

【参数】

dateTime (datetime.datetime.) ,计算给定时间点的数据。如果没有足够的数据值,将返回 None

47

【类定义】

pyalgotrade.technical.linreg.Slope(dataSeries, period, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

计算最小二次回归线的斜率

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

period (int.) ,需计算的数值数目。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

【注意】

请注意 这个过滤器忽略不同的值,之间的时间差别。

标准方差

【类定义】

pyalgotrade.technical.stats.StdDev(dataSeries, period, ddof=0, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

period (int.) ,需计算的数值数目。

ddof (int.) ,Delta 自由度。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

z 分数过滤

【类定义】

pyalgotrade.technical.stats.ZScore(dataSeries, period, ddof=0, maxLen=1024)

基类 Bases: pyalgotrade.technical.EventBasedFilter

【参数】

dataSeries (pyalgotrade.dataseries.DataSeries.) ,被过滤的 DataSeries 实例。

48

ddof (int.) ,Delta 自由度。

maxLen (int.) ,数值的最大数量。 当数据序列长度已满,再添加新数值,一个相应数据包从队列头被丢弃。

broker 模块,订单管理

基础模块

Order 订单

【类定义】

pyalgotrade.broker.Order(type_, action, instrument, quantity, instrumentTraits)

基类 Bases: object

【参数】

type (Order.Type) ,订单类型

action (Order.Action) ,订单操作

instrument (string.),工具 ID 标识符

quantity (int/float.) ,订单数量。

【注意】

这是一个基础类定义,不要直接使用

有效的 类型 参数值是:

Order.Type.MARKET

Order.Type.LIMIT

Order.Type.STOP

Order.Type.STOP_LIMIT

有效的 行动 参数值是:

Order.Action.BUY

Order.Action.BUY_TO_COVER

Order.Action.SELL

Order.Action.SELL_SHORT

getId(),返回值:返回订单 id。 【注意】如果没有订单,返回:None

getType(),返回值:返回订单类型。

有效的订单类型:

Order.Type.MARKET

Order.Type.LIMIT

49

Order.Type.STOP_LIMIT

getSubmitDateTime(),返回值:返回订单提交时的时间日期。

getAction(),返回值:返回订单操作命令。

有效订单操作命令:

Order.Action.BUY

Order.Action.BUY_TO_COVER

Order.Action.SELL

Order.Action.SELL_SHORT

getState(),返回值:返回订单状态。

有效的订单状态是:

Order.State.INITIAL ,初始状态

Order.State.SUBMITTED,提交

Order.State.ACCEPTED,接受

Order.State.CANCELED,取消

Order.State.PARTIALLY_FILLED,完成部分交易

Order.State.FILLED,完成全部交易

isActive(),返回值:True if the order is active.

isInitial(),返回值:如果订单状态是 Order.State.INITIAL 返回 True。

isSubmitted(),返回值:如果订单状态是 Order.State.SUBMITTED 返回 True。

isAccepted(),返回值:如果订单状态是 Order.State.ACCEPTED 返回 True。

isCanceled(),返回值:如果订单状态是 Order.State.CANCELED. 返回 True。

isPartiallyFilled(),返回值:如果订单状态是 Order.State.PARTIALLY_FILLED. 返回 True。

isFilled(),返回值:如果订单状态是 Order.State.FILLED. 返回 True。

getInstrument(),返回值:返回数据工具的 ID 标识符。

getQuantity(),返回值:数量.

getFilled(),返回值:返回成交股票的数量

getRemaining(),返回值:返回剩余股票的数量

getAvgFillPrice(),返回值:如果交易完成,返回股票的平均价格;如果没有,返回·None。

getGoodTillCanceled(),返回值:长期有效委托书

setGoodTillCanceled(goodTillCanceled),设置长期有效委托书

【参数】

goodTillCanceled (boolean.),为 True,如果采用长期有效委托书

【注意】

订单一旦提交,不能改变。

getAllOrNone(),返回值:如果订单全部完成, 返回 True。

setAllOrNone(allOrNone),为订单设置:All-Or-None 属性

50

allOrNone (boolean.),如果订单全部完成, 返回 True。

【注意】

订单一旦提交,不能改变。

getExecutionInfo(),返回值:最后一次执行此订单的信息,如果没有完成,返回 None。

返回类型:OrderExecutionInfo.

MarketOrder 订单市场

【类定义】

pyalgotrade.broker.MarketOrder(action, instrument, quantity, onClose, instrumentTraits)

基类 Bases: pyalgotrade.broker.Order

【注意】

这是一个基础类定义,不要直接使用

getFillOnClose(),返回值:返回 True,如果订单应尽可能靠近收盘价(Market-On-Close 订单)。

LimitOrder 限价指令。

【类定义】

pyalgotrade.broker.LimitOrder(action, instrument, limitPrice, quantity, instrumentTraits)

基类 Bases: pyalgotrade.broker.Order

【注意】

这是一个基础类定义,不要直接使用

getLimitPrice(),返回值:限制价格。

StopOrder 限损订单

【类定义】

pyalgotrade.broker.StopOrder(action, instrument, stopPrice, quantity, instrumentTraits)

基类 Bases: pyalgotrade.broker.Order

51

这是一个基础类定义,不要直接使用

getStopPrice(),返回值:限损价格.

StopLimitOrder 限价止损订单

【类定义】

pyalgotrade.broker.StopLimitOrder(action, instrument, stopPrice, limitPrice, quantity, instrumentTraits)

基类 Bases: pyalgotrade.broker.Order

【注意】

这是一个基础类定义,不要直接使用

getStopPrice(),返回值:限损价格

getLimitPrice(),返回值:限制价格

OrderExecutionInfo 订单执行信息

【类定义】

pyalgotrade.broker.OrderExecutionInfo(price, quantity, commission, dateTime)

基类 Bases: object

getPrice(),返回值:成交价

getQuantity(),返回值:成交量

getCommission(),返回值:佣金。

getDateTime(),返回值:订单成交时间

Broker 交易模块

【类定义】

pyalgotrade.broker.Broker

基类 Bases: pyalgotrade.observer.Subject

【注意】

这是一个基础类定义,不要直接使用

getCash(includeShort=True),返回值:可用的现金。

52

includeShort (boolean.) ,现金,包括空头头寸。

getShares(instrument),返回值:买到的股票数目。

getPositions(),返回值:股票-数据工具、映射字典数据表

getActiveOrders(instrument=None),返回值:活跃订单数据列表

【参数】

instrument (string.) ,可选数据工具标识符,仅返回活动订单相关的。

submitOrder(order)提交订单。

【参数】

order (Order.) ,需要提交的订单。

【注意】

SUBMITTED 订单提交状态,不会触发事件。

两次调用相同的订单,将引发异常。

创建市场订单。市场订单,是为了,在最好的价格,购买或出售股票。

一般来说,这种类型的订单将立即执行,但不能完全保证。

【参数】

action (Order.Action.BUY, or Order.Action.BUY_TO_COVER,

or Order.Action.SELL or Order.Action.SELL_SHORT.) ,订单操作

instrument (string.) ,工具标识符

quantity (int/float.) ,订单交易量

onClose (boolean.) ,返回 True,如果订单应尽可能靠近收盘价(Market-On-Close 订单)。默认是 False.

返回类型: 一个 MarketOrder 子类。

createLimitOrder(action, instrument, limitPrice, quantity)

创建一个限价订单。 限价订单,是以特定价格,购买或出售股票。

参 数 : 行 动 ( Order.Action 。 购 买 , 或 Order.Action 。 BUY_TO_COVER 或 Order.Action 。 出 售 或

Order.Action.SELL_SHORT。 )- - -订单操作。 仪器 ( 字符串。 )——仪器标识符。 limitPrice ( 浮动 )- - -订单价

格。 数量 ( int /浮动。 )- - -订单数量。 返回类型: 一个 LimitOrder 子类。

【参数】

action (Order.Action.BUY, or Order.Action.BUY_TO_COVER,

or Order.Action.SELL or Order.Action.SELL_SHORT.) ,订单操作

instrument (string.) ,工具标识符

limitPrice (float) ,订单价格

quantity (int/float.) ,订单交易量

返回类型: 一个 LimitOrder 子类

53

createStopOrder(action, instrument, stopPrice, quantity)

创建一个限损订单。限损订单,也称为止损订单,一旦股票的价格 达到指定的价格时,称为停止价格,购买或

出售股票。

参 数 : 行 动 ( Order.Action 。 购 买 , 或 Order.Action 。 BUY_TO_COVER 或 Order.Action 。 出 售 或

Order.Action.SELL_SHORT。 )- - -订单操作。 仪器 ( 字符串。 )——仪器标识符。 stopPrice ( 浮动 )- - -触发价格。

数量 ( int /浮动。 )- - -订单数量。 返回类型: 一个 StopOrder 子类。

【参数】

action (Order.Action.BUY, or Order.Action.BUY_TO_COVER,

or Order.Action.SELL or Order.Action.SELL_SHORT.) ,订单操作

instrument (string.) ,工具标识符

stopPrice (float),预设价格

quantity (int/float.) ,订单交易量

返回类型: 一个 StopOrder 子类

createStopLimitOrder(action, instrument, stopPrice, limitPrice, quantity)

限价止损订单。

【参数】

action (Order.Action.BUY, or Order.Action.BUY_TO_COVER,

or Order.Action.SELL or Order.Action.SELL_SHORT.) ,订单操作

instrument (string.) ,工具标识符

stopPrice (float), 预设止损价格

limitPrice (float) ,预设限制价格

quantity (int/float.) ,订单交易量

返回类型: 一个 StopLimitOrder 子类

cancelOrder(order),请求取消订单。 如果订单完成,会抛出一个例外:Exception。

【参数】

order (Order.) ,要取消的订单

Backtesting 回溯模块

Commission 佣金

【类定义】

pyalgotrade.broker.backtesting.Commission

基类 Bases: object

54

【注意】

这是一个基础类定义,不要直接使用

calculate(order, price, quantity),计算订单的佣金

【参数】

order (pyalgotrade.broker.Order.),正在执行的订单.

price (float.) ,每股的价格

quantity (float.) ,订单成交量

返回类型: float.

NoCommission 无佣金

【类定义】

pyalgotrade.broker.backtesting.NoCommission

基类 Bases: pyalgotrade.broker.backtesting.Commission

总是返回 0 佣金

FixedPerTrade 固定佣金

【类定义】

pyalgotrade.broker.backtesting.FixedPerTrade(amount)

基类 Bases: pyalgotrade.broker.backtesting.Commission

【参数】

amount (float.) ,每个订单的固定佣金

TradePercentage 浮动佣金

【类定义】

pyalgotrade.broker.backtesting.TradePercentage(percentage)

基类 Bases: pyalgotrade.broker.backtesting.Commission

【参数】

percentage (float.) ,佣金收取比例,0.01 意味着 1%,等等。 必须小于 1。

55

【类定义】

pyalgotrade.broker.backtesting.Broker(cash, barFeed, commission=None)

基类 Bases: pyalgotrade.broker.Broker

【参数】

cash (int/float.) ,最初的现金数额

barFeed (pyalgotrade.barfeed.BarFeed) ,bar 数据集

commission (Commission) ,佣金计算

getCommission(),返回值:策略说需的佣金。返回类型: Commission.

getEquity(),返回值:投资组合的回报价值(现金+股票)。

getFillStrategy(),返回值:FillStrategy 当前的值.

setCommission(commission),设置策略使用佣金计算模式。

【参数】

commission (Commission.) ,计算佣金。

setFillStrategy(strategy),设置首页的策略

SlippageModel 滑移模型

【类定义】

pyalgotrade.broker.slippage.SlippageModel

基类 Bases: object

【注意】

这是一个基础类定义,不要直接使用

calculatePrice(order, price, quantity, bar, volumeUsed)

返回值:订单的每股下滑价格。

【参数】

order (pyalgotrade.broker.Order.),全部交易订单

price (float.) ,滑动前的每股价格

quantity (float.),订单总量

bar (pyalgotrade.bar.Bar.) ,当前的 bar 数据集

volumeUsed (float.) ,当前 bar 数据集所需的成交量

返回类型: float.

56

【类定义】

pyalgotrade.broker.slippage.NoSlippage

基类 Bases: pyalgotrade.broker.slippage.SlippageModel

VolumeShareSlippage 成交量滑移模型

【类定义】

pyalgotrade.broker.slippage.VolumeShareSlippage(priceImpact=0.1)

基类 Bases: pyalgotrade.broker.slippage.SlippageModel

【参数】

priceImpact (float.) ,预设回溯测试价格。

FillStrategy 成交策略

【类定义】

pyalgotrade.broker.fillstrategy.FillStrategy

基类 Bases: object

fillLimitOrder (broker_, order, bar)

返回值,会覆盖成交价和成交量,如果订单,不能在给定的时间,完成,返回:None。

【参数】

broker (Broker) ,交易员

order (pyalgotrade.broker.LimitOrder) ,订单

bar (pyalgotrade.bar.Bar) ,当前 bar.数据集

返回类型: FillInfo 或者 None

fillMarketOrder(broker_, order, bar)

返回值,会覆盖成交价和成交量,如果订单,不能在给定的时间,完成,返回:None。

【参数】

broker (Broker) ,交易员

order (pyalgotrade.broker.LimitOrder) ,订单

bar (pyalgotrade.bar.Bar) ,当前 bar.数据集

返回类型: FillInfo 或者 None

57

fillStopLimitOrder(broker_, order, bar)

返回值,会覆盖成交价和成交量,如果订单,不能在给定的时间,完成,返回:None。

【参数】

broker (Broker) ,交易员

order (pyalgotrade.broker.LimitOrder) ,订单

bar (pyalgotrade.bar.Bar) ,当前 bar.数据集

返回类型: FillInfo 或者 None

fillStopOrder(broker_, order, bar)

返回值,会覆盖成交价和成交量,如果订单,不能在给定的时间,完成,返回:None。

【参数】

broker (Broker) ,交易员

order (pyalgotrade.broker.LimitOrder) ,订单

bar (pyalgotrade.bar.Bar) ,当前 bar.数据集

返回类型: FillInfo 或者 None

onBars(broker_, bars)

当交易处理新的 Bar 数据集时,覆盖时(可选)得到通知信息。

【参数】

broker (Broker) ,交易员

bars (pyalgotrade.bar.Bars) ,当前 bar.数据集

onOrderFilled(broker_, order),覆盖(可选) 通知,当订单完成,或部分完成时。

onOrderFilled ( broker_ , Order))

覆盖(可选)得到通知,当订单完成,或部分完成时。

【参数】

broker (Broker) ,交易员

order (pyalgotrade.broker.Order),已经完成的订单

默认填充策略

【类定义】

pyalgotrade.broker.fillstrategy.DefaultStrategy(volumeLimit=0.25)

基类 Bases: pyalgotrade.broker.fillstrategy.FillStrategy

【参数】

volumeLimit (float) ,浮动成交量比率,必须 > 0and <= 1.

这一策略,总是使用开盘/收盘价。

58

如果 bar 数据集,包括限制价,使用限制价。

setSlippageModel(slippageModel),设置使用的滑动模型。

【参数】

slippageModel (pyalgotrade.broker.slippage.SlippageModel) ,滑动模型

setVolumeLimit(volumeLimit),设置成交量限制

【参数】

volumeLimit (float) ,成交量浮动比率,必须 > 0and <= 1

59

策略定义类,用于实现交易的逻辑,什么时候买,什么时候卖,等等。

买卖可以通过两种方式:

个人订单使用下列方法:

pyalgotrade.strategy.BaseStrategy.marketOrder()

pyalgotrade.strategy.BaseStrategy.limitOrder()

pyalgotrade.strategy.BaseStrategy.stopOrder()

pyalgotrade.strategy.BaseStrategy.stopLimitOrder()

更高级别的接口,订单双向进入/退出:

pyalgotrade.strategy.BaseStrategy.enterLong()

pyalgotrade.strategy.BaseStrategy.enterShort()

pyalgotrade.strategy.BaseStrategy.enterLongLimit()

pyalgotrade.strategy.BaseStrategy.enterShortLimit()

Strategy

【类定义】

pyalgotrade.strategy.BaseStrategy(barFeed, broker)

基类 Bases: object

【参数】

barFeed (pyalgotrade.barfeed.BaseBarFeed.) ,bar 数据源.

broker (pyalgotrade.broker.Broker.),交易员处理订单

【注意】

这是一个基础类定义,不要直接使用

getFeed(),返回值:当前策略的数据源

getBroker(),返回值:当前订单的交易员

getCurrentDateTime(),返回值:时间

marketOrder(instrument, quantity, onClose=False, goodTillCanceled=False, allOrNone=False)

提交市场订单

【参数】

60

instrument (string.),工具 ID 标识符

quantity (int/float.),股票数量,正数代表买进,负数代表卖出

onClose (boolean.) ,返回 True,如果订单应尽可能靠近收盘价(Market-On-Close 订单)。默认值是 False

goodTillCanceled (boolean.) ,返回 True,取消前,维持订单交易;如果是 False,当前对话关闭时,订单会自动

取消。

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

返回类型: pyalgotrade.broker.MarketOrder

limitOrder(instrument, limitPrice, quantity, goodTillCanceled=False, allOrNone=False)

提交限价订单。

【参数】

instrument (string.) ,工具 ID 标识符

limitPrice (float.) ,限制价格

quantity (int/float.),股票数量,正数代表买进,负数代表卖出

goodTillCanceled (boolean.),返回 True,取消前,维持订单交易;如果是 False,当前对话关闭时,订单会自动取

消。

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

返回类型: pyalgotrade.broker.LimitOrder

stopOrder(instrument, stopPrice, quantity, goodTillCanceled=False, allOrNone=False)

提交止损订单。

【参数】

instrument (string.) ,工具 ID 标识符

stopPrice (float.) ,设置价格

quantity (int/float.),股票数量,正数代表买进,负数代表卖出

goodTillCanceled (boolean.),返回 True,取消前,维持订单交易;如果是 False,当前对话关闭时,订单会自动取

消。

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

返回类型: pyalgotrade.broker.StopOrder

stopLimitOrder(instrument, stopPrice, limitPrice, quantity, goodTillCanceled=False, allOrNone=False)

提交限制止损订单。

【参数】

instrument (string.) ,工具 ID 标识符

stopPrice (float.) ,设置价格

limitPrice (float.) ,设置数量

quantity (int/float.),股票数量,正数代表买进,负数代表卖出

goodTillCanceled (boolean.),返回 True,取消前,维持订单交易;如果是 False,当前对话关闭时,订单会自动取

61

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

返回类型: pyalgotrade.broker.StopLimitOrder

enterLong(instrument, quantity, goodTillCanceled=False, allOrNone=False)

Generates a buy pyalgotrade.broker.MarketOrder to enter a long position.

生成一个多头买进订单

【参数】

instrument (string.) ,工具 ID 标识符

quantity (int.),订单数量

goodTillCanceled (boolean.) ,返回 True,取消前,维持订单交易;如果是 False,当前对话关闭时,订单会自动

取消。

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

返回类型: pyalgotrade.strategy.position.Position

enterShort(instrument, quantity, goodTillCanceled=False, allOrNone=False)

生成一个空头卖出订单

【参数】

instrument (string.) ,工具 ID 标识符

quantity (int.),订单数量

goodTillCanceled (boolean.) ,返回 True,取消前,维持订单交易;如果是 False,当前对话关闭时,订单会自动

取消。

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

返回类型: pyalgotrade.strategy.position.Position

enterLongLimit(instrument, limitPrice, quantity, goodTillCanceled=False, allOrNone=False)

生成一个多头买进限价订单

【参数】

instrument (string.) ,工具 ID 标识符

limitPrice (float.) ,设置价格

quantity (int.),订单数量

goodTillCanceled (boolean.) ,返回 True,取消前,维持订单交易;如果是 False,当前对话关闭时,订单会自动

取消。

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

返回类型:

The pyalgotrade.strategy.position.Position entered.

enterShortLimit(instrument, limitPrice, quantity, goodTillCanceled=False, allOrNone=False)

Generates a sell short pyalgotrade.broker.LimitOrder to enter a short position.

【参数】

62

instrument (string.) ,工具 ID 标识符

limitPrice (float.) ,设置价格

quantity (int.),订单数量

goodTillCanceled (boolean.) ,返回 True,取消前,维持订单交易;如果是 False,当前对话关闭时,订单会自动

取消。

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

返回类型: pyalgotrade.strategy.position.Position

enterLongStop(instrument, stopPrice, quantity, goodTillCanceled=False, allOrNone=False)

生成一个多头买进止损订单

【参数】

instrument (string.) ,工具 ID 标识符

stopPrice (float.) ,设置价格

quantity (int.),订单数量

goodTillCanceled (boolean.) ,返回 True,取消前,维持订单交易;如果是 False,当前对话关闭时,订单会自动

取消。

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

返回类型:

The pyalgotrade.strategy.position.Position entered.

enterShortStop(instrument, stopPrice, quantity, goodTillCanceled=False, allOrNone=False)

Generates a sell short pyalgotrade.broker.StopOrder to enter a short position.

【参数】

instrument (string.) ,工具 ID 标识符

stopPrice (float.) ,设置价格

quantity (int.),订单数量

goodTillCanceled (boolean.) ,返回 True,取消前,维持订单交易;如果是 False,当前对话关闭时,订单会自动

取消。

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

返回类型: pyalgotrade.strategy.position.Position

enterLongStopLimit(instrument, stopPrice, limitPrice, quantity, goodTillCanceled=False, allOrNone=False)

生成一个多头买进限制止损订单

【参数】

instrument (string.) ,工具 ID 标识符

stopPrice (float.) ,设置价格

limitPrice (float.) ,设置价格

quantity (int.),订单数量

goodTillCanceled (boolean.) ,返回 True,取消前,维持订单交易;如果是 False,当前对话关闭时,订单会自动

63

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

返回类型: pyalgotrade.strategy.position.Position

enterShortStopLimit(instrument, stopPrice, limitPrice, quantity, goodTillCanceled=False, allOrNone=False)

生成一个空头卖出限制止损订单

【参数】

instrument (string.) ,工具 ID 标识符

stopPrice (float.) ,设置价格

limitPrice (float.) ,设置价格

quantity (int.),订单数量

goodTillCanceled (boolean.) ,返回 True,取消前,维持订单交易;如果是 False,当前对话关闭时,订单会自动

取消。

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

返回类型: pyalgotrade.strategy.position.Position

onEnterOk(position)

覆盖(可选),得到通知,提交订单全部成交。默认是空的。

【参数】

position (pyalgotrade.strategy.position.Position.),成交位置

onEnterCanceled(position)

覆盖(可选),得到通知,提交订单已经取消。默认是空的。

【参数】

position (pyalgotrade.strategy.position.Position.) ,成交位置

onExitOk(position)

覆盖(可选),得到通知,提交订单退出价位已经完成。默认是空的。

【参数】

position (pyalgotrade.strategy.position.Position.) ,成交位置

onExitCanceled(position)

覆盖(可选),得到通知,提交订单退出价位已经取消。默认是空的。

【参数】

position (pyalgotrade.strategy.position.Position.) ,成交位置

onStart()

覆盖(可选),得到通知,策略已经开始执行。默认是空的。

onFinish(bars)

覆盖(可选),得到通知,策略已经已经完成。默认是空的。

64

bars (pyalgotrade.bar.Bars.) ,最后处理的 bar 数据集

onIdle()

覆盖(可选),得到通知,没有事件。

【注意】

在纯回溯测试情况下,这个事件,不会被触发。

onBars(bars)

覆盖(强制性的),得到通知。新的 bar 数据集可用的。

默认实现提出了一个例外。采用重写的方法,操作你的策略和订单。

【参数】

bars (pyalgotrade.bar.Bars.) ,当前 bar.数据集

onOrderUpdated(order),覆盖(可选),得到通知,订单已经更新。

【参数】

order (pyalgotrade.broker.Order.) ,更新的订单

run(),运行一次(而且只有一次)策略。

stop(),停止正在运行的策略

attachAnalyzer(strategyAnalyzer)

添加一个策略分析

debug(msg),调试策略。

info(msg),记录策略信息

warning(msg),发布警告信息

error(msg),发布错误信息

critical(msg),发布紧急 CRITICAL(临界)信息

resampleBarFeed(frequency, callback)

Builds a resampled barfeed that groups bars by a certain frequency.

对 bar 数据集,重新取样。

【参数】

frequency ,每秒频率,必须>0

callback ,类似 onbar 的函数,用新的 bar 数据集调用

返回类型:pyalgotrade.barfeed.BaseBarFeed.

BaseStrategy 基础策略类

【类定义】

65

pyalgotrade.strategy.BacktestingStrategy(barFeed, cash_or_brk=1000000)

基类 Bases: pyalgotrade.strategy.BaseStrategy

【参数】

barFeed (pyalgotrade.barfeed.BaseBarFeed.) ,回溯数据

cash_or_brk (int/float or pyalgotrade.broker.Broker.),初始这本与交易员

【注意】

这是一个基础类定义,不要直接使用

setDebugMode(debugOn)

启用/禁用 debug 调试模式。默认启用。

Position 价位

【类定义】

pyalgotrade.strategy.position.Position(strategy, entryOrder, goodTillCanceled, allOrNone)

基类 Bases: object

Positions 价位,是订单的更高层次的抽象。

【参数】

strategy (pyalgotrade.strategy.BaseStrategy.) ,所用策略

entryOrder (pyalgotrade.broker.Order) ,订单目标价位

goodTillCanceled (boolean.) ,为 True 时,取消前,维持订单

allOrNone (boolean.) ,为 True 时,订单应该全部完成或者取消。

【注意】

这是一个基础类定义,不要直接使用

getShares(),返回值:股票数量。 正数表示多头买进,负数表示空头卖出

【注意】

如果订单顺序没有完成,或者价位是关闭的,那么,股票数量将是 0。

entryActive(),返回值:True,如果订单是活跃的。

entryFilled(),返回值:True,如果订单已经完成。

exitActive(),返回值:True,如果退出订单是活跃的。

exitFilled(),返回值:True,如果退出订单已经完成。

getEntryOrder(),返回值:订单进入价位

getExitOrder(),返回值:订单退出价位,如果价位关闭,返回 None

66

getReturn(includeCommissions=True),累积收益

【参数】

includeCommissions (boolean.) ,为 True,包括佣金计算

getPnL(includeCommissions=True),计算 PnL

【参数】

includeCommissions (boolean.) ,为 True,包括佣金计算

cancelEntry(),取消活跃订单

cancelExit(),取消活跃退出订单

exitMarket(goodTillCanceled=None),提交市场关闭订单,在指定价位

【参数】

goodTillCanceled (boolean.) ,为 True 时,取消前,维持订单

【注意】

exitLimit(limitPrice, goodTillCanceled=None) ,提交限价订单,在指定价位

【参数】

limitPrice (float.) ,指定价格

goodTillCanceled (boolean.) ,为 True 时,取消前,维持订单

exitStop(stopPrice, goodTillCanceled=None) ,提交止损订单,在指定价位

【参数】

stopPrice (float.) ,指定价格

goodTillCanceled (boolean.) ,为 True 时,取消前,维持订单

exitStopLimit(stopPrice, limitPrice, goodTillCanceled=None)

提交限价止损订单,在指定价位

【参数】

stopPrice (float.) ,指定价格

limitPrice (float.) ,指定价格

goodTillCanceled (boolean.) ,为 True 时,取消前,维持订单

isOpen(),返回值:True,如果指定价位是开放的

getAge(),返回值:开放状态的持续时间。

返回类型: datetime.timedelta.

67

策略分析模块,析提供了一个可扩展的方法,来连接多个不同的策略。

strategyanalyzer 策略分析

【类定义】

pyalgotrade.stratanalyzer.StrategyAnalyzer

基类 Bases: object

【注意】

这是一个基础类定义,不要直接使用

Returns 收益率策略

【类定义】

pyalgotrade.stratanalyzer.returns.Returns

基类 Bases: pyalgotrade.stratanalyzer.StrategyAnalyzer

计算投资组合,当前的,时间加权回报率(收益率)。

getCumulativeReturns(),返回值:每个 bar 数据集的累计收益率

getReturns(),返回值:每个 bar 数据集的收益率

Sharpe Ratio 夏普比率

【类定义】

pyalgotrade.stratanalyzer.sharpe.SharpeRatio(useDailyReturns=True)

基类 Bases: pyalgotrade.stratanalyzer.StrategyAnalyzer

计算投资组合,当前的,夏普比率

【参数】

useDailyReturns (boolean.) ,为 True 时,采用每日收益率,而不要说 bar 每个 bar 数据集收益率

getSharpeRatio(riskFreeRate, annualized=True),

返回值:当前策略收益的夏普比率。如果波动为 0,返回 0。

【参数】

riskFreeRate (int/float.) ,无风险利率

annualized (boolean.) ,为 True 时,采用年化的夏普比率

68

【类定义】

pyalgotrade.stratanalyzer.drawdown.DrawDown

基类 Bases: pyalgotrade.stratanalyzer.StrategyAnalyzer

计算投资组合,使用减少策略,相关的持续时间。

getLongestDrawDownDuration(),返回值:最长持续时间

返回类型: datetime.timedelta.

getMaxDrawDown(),返回值:最大减少值. (deepest) drawdown.

Trades 交易模块

【类定义】

pyalgotrade.stratanalyzer.trades.Trades

基类 Bases: pyalgotrade.stratanalyzer.StrategyAnalyzer

记录每个完成订单的利润/亏损。

getCount(),返回值:交易总数。

getProfitableCount(),返回值:获利交易订单数量。

getUnprofitableCount(),返回值:未获利交易订单数量。

getEvenCount(),返回值:0 获利交易订单数量

getAll(),返回值:结果数组,每笔交易的利润/亏损。

getProfits(),返回值:结果数组,每笔获利交易交易的利润

getLosses(),返回值:结果数组,每笔未获利交易交易的亏损额度

getAllReturns(),返回值:结果数组,所有交易回报

getPositiveReturns(),返回值:结果数组,所有正回报(盈利)交易

getNegativeReturns(),返回值:结果数组,所有负回报(亏损)交易

getCommissionsForAllTrades(),返回值:所有交易的佣金数据数组

getCommissionsForProfitableTrades(),返回值:所有获利交易的佣金数据数组

getCommissionsForUnprofitableTrades(),返回值:所有未获利交易的佣金数据数组

getCommissionsForEvenTrades(),返回值:所有 0 获利交易的佣金数据数组

69

from pyalgotrade import strategy

from pyalgotrade.technical import ma

from pyalgotrade.technical import cross

class SMACrossOver(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, smaPeriod):

strategy.BacktestingStrategy.__init__(self, feed)

self.__instrument = instrument

self.__position = None

# We'll use adjusted close values instead of regular close values.

self.setUseAdjustedValues(True)

self.__prices = feed[instrument].getPriceDataSeries()

self.__sma = ma.SMA(self.__prices, smaPeriod)

def getSMA(self):

return self.__sma

def onEnterCanceled(self, position):

self.__position = None

def onExitOk(self, position):

self.__position = None

def onExitCanceled(self, position):

# If the exit was canceled, re-submit it.

self.__position.exitMarket()

def onBars(self, bars):

# If a position was not opened, check if we should enter a long position.

if self.__position is None:

if cross.cross_above(self.__prices, self.__sma) > 0:

shares = int(self.getBroker().getCash() * 0.9 / bars[self.__instrument].getPrice())

# Enter a buy market order. The order is good till canceled.

self.__position = self.enterLong(self.__instrument, shares, True)