before you start, please read last chapter about How Data Technology Drives Business Innovation in Chinese Market(https://www.modb.pro/db/23549)

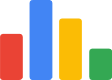

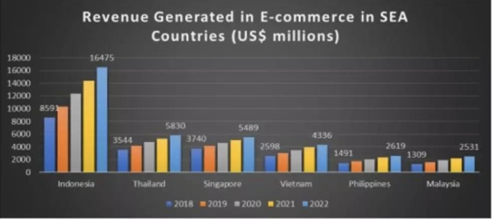

This chart is an analysis of the growth predicate of the ASEAN data center. The horizontal represents the data center growth rate for 2017, and the vertical indicates the growth rate estimate for the next seven-eight years. We can see that the analysis results in three major groups. The first group consists of Indonesia, Thailand and Vietnam, and both the data center’s current growth rate and future growth potential are high.

The second group is represented by the Philippines, Myanmar and Malaysia. Current and future growth is lower, And the third group, represented by Singapore and Taiwan, has a relatively high growth rate right now, but has little potential for growth in the future.

The different groups here represent the different stages of development of the market. Take the first group as example, Vietnam, Thailand and Indonesia. the demand for Internet development in these countries is strong with large population, and the penetration rate of smartphones and the Internet of business is up to 80% to 90%. It has driven a series of business changes such as e-commerce, e-banking, mobile banking, and electronic payment. These markets are right in the fast-moving stage of mobile Internet.

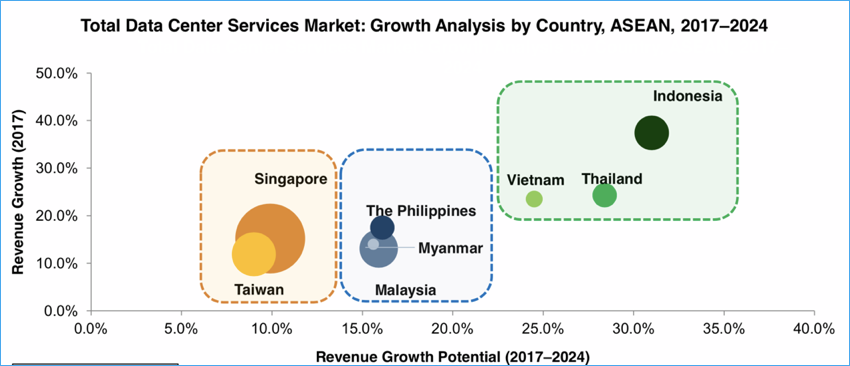

Due to Thailand’s geographical advantages and abundant resources, it is attracting for global ultra-large-scale cloud service providers to invest in building data centers in Thailand, for example, Ali and Huawei has built data center in Thailand respectively. Thus, greatly promote the demand for resource hosting. This picture shows that the two main business output models of the data center in Thailand, that is managed hosting and Co-location, have shown a good growth trend in the following 7- 8 years.

The construction of the data center has laid the environmental foundation for the development of the mobile Internet: since 4G will realize faster connection with new services through smart phones, in some industries, such as Internet, communication, financial services, etc., mobile payment, Solutions such as e-commerce and online logistics will be the key solutions.

As shown in this report, Thailand has a population of 69million, and the number of Internet users is nearly 92 million, with a penetration rate of of 82%, which is 133% of the population .

Let’s take a look at Thailand’s developments in mobile payments, e-commerce and online logistics.

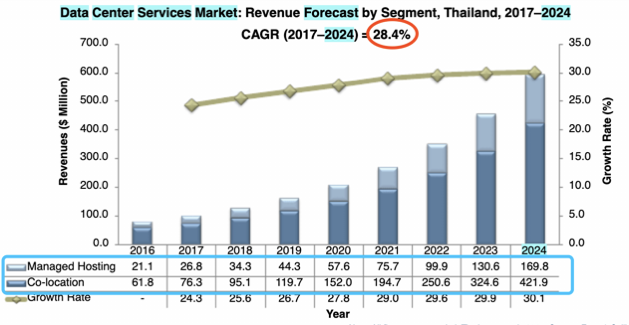

Like other countries in Southeast Asia, Thailand is encouraging more industries to participate in the adoption of mobile payments, including government agencies, financial institutions and financial technology companies, all of which are actively working to raise awareness and accelerate adoption of mobile payments.

According to the Ernst & Young Southeast Asia Fintech 2018 report, Thailand Mobile Payments accounted for the largest share of the country’s financial technology industry, with 30% of the country’s 100+ financial technology startups in the payment sector.

Many mobile payment wallet players are currently expanding their services scope, such as TrueMoney wallet, which has expanded into services such as cross-border remittances, payment gateways, cash on delivery and game recharge.

Similarly, companies including LINE, Garena, and Lazada use their vast user base to promote wallet services. LINE offers Rabbit LINE Pay; Garena offers AirPay payment services; Lazada launched Lazada wallet last year. Not long ago, Southeast Asian network car giant Grab announced cooperation with Kasikornbank and launched its mobile wallet GrabPay and other financial services in Thailand.

In addition to financial technology companies, the Thai government has also participated in the establishment of the mobile payment ecosystem. The electronic interbank transfer system PromptPay is a typical example. The PromptPay platform is part of Thailand’s national digital payment program, which aims to push Thailand to a cashless society. It is also part of the Thai 4.0 program.

The second core area is e-commerce

The Thai e-commerce market is still very fragmented compared to China, and there is still no giant monopoly. Which means at this time and stage, there is good chance to change the landscape of the industry.

Thai consumer behavior is very different from that of China. Most of the transactions are conducted on social media such as Facebook ,Instagram and other platform. Merchants send their products to social media, consumers learn about product information through chat, and bargain with merchants.This is their main online trading method.

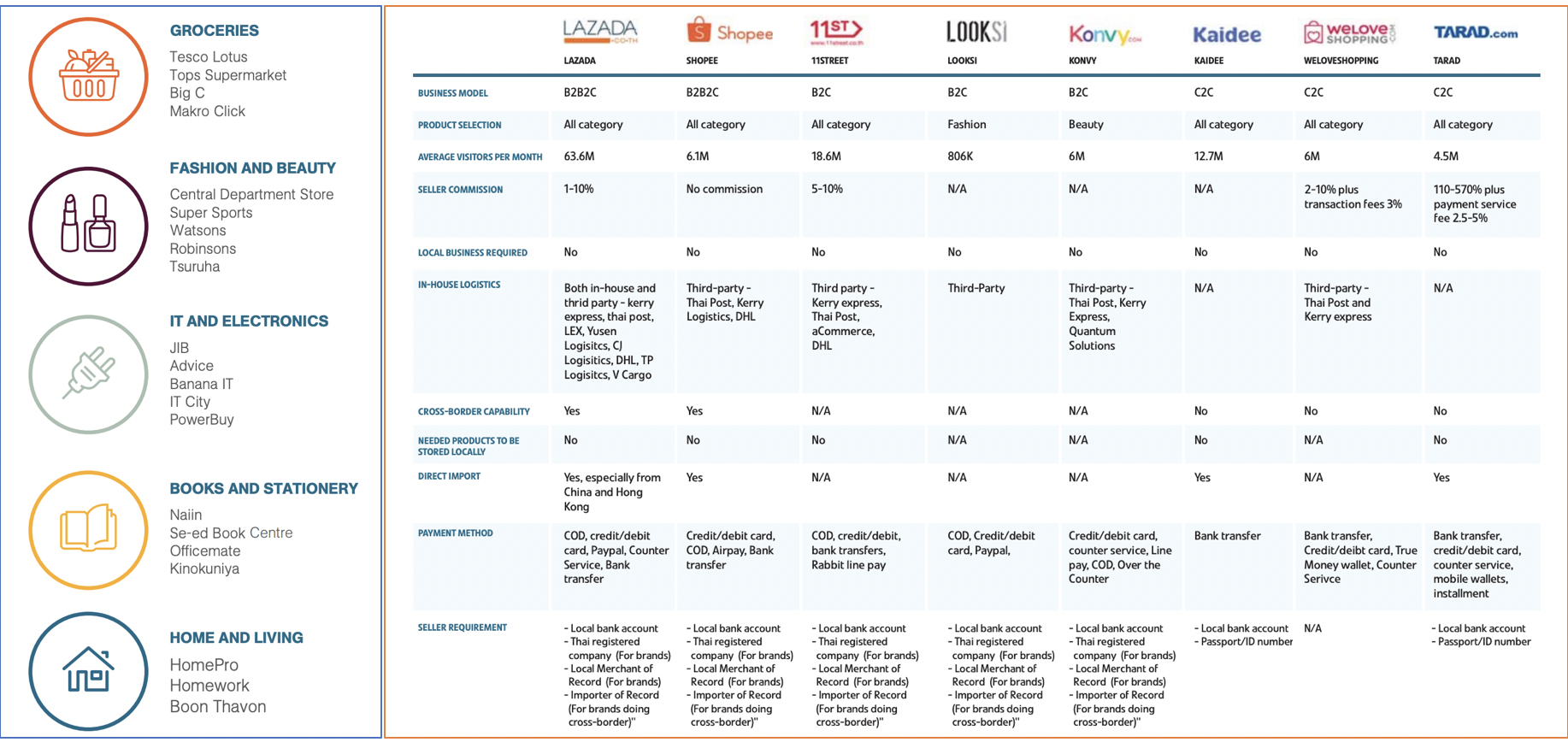

As shown here is A list of specialised e-commerce marketplaces in Thailand

Lazada and Shopee are the most popular e-commerce platforms in Southeast Asia, as well as in Thailand.

Lazada

Lazada is currently one of the largest and most popular e-commerce platforms in Southeast Asia. Founded in 2007 by Rocket Internet, Germany, established a global headquarters in Singapore in 2012,and Since 2016, Alibaba Group has acquired Lazada and became its largest shareholder.

Shopee

Shopee was established in Singapore in 2015. Tencent holds 40% of Shopee and is one of its largest shareholders. The main method of e-commerce transactions is: COD cash on delivery.

In order to better support the development of e-commerce, many e-commerce platforms have begun to provide users with fast shipping services. Take Lazada as an example. After the user submit an order, they can get the Lazada Express service for a fee ranging from 100铢 to 300铢 to ensure that the goods are delivered to the door of the consumers. Bangkok and the surrounding area are served 1-2 days, while the remote places usually take 7-15 days.

In the process of rapid business development, it also faces many challenges.

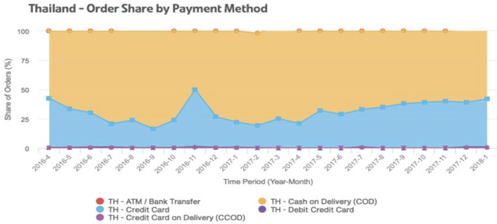

- The challenge of electronic payment: The low penetration rate of electronic payment is the main factor restricting the development of Internet companies in Thailand. most consumers in Thailand prefer cash payments when shopping online. According to a Commerce’s February 2017 data, more than 3/4 (78.7%) of the online shopping shares on its platform were cash on delivery, with a credit card accounting for 20.9% and a debit card accounting for only 0.9%.

Excessive cash payment ratio means that Internet companies cannot obtain sufficient cash flow through online electronic delivery, and cash flow directly determines the value creation ability of enterprises.

-

E-commerce challenges: At present, the main payment method for e-commerce is COD, which leads to a very high rate of return (the seller has not paid), so the average cost per order will be higher.

-

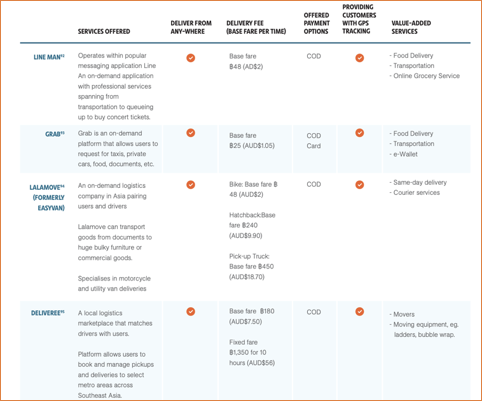

Logistics challenges: The slow transportation speed of logistics and the small spread of “fast shipping” also limit the development of the Internet.

All of these limitations stem from the imperfections of the IT infrastructure. We look at the challenges currently facing the rapid development and rapid advancement of the Internet from the perspective of infrastructure and technology:

the current challenges include:

- Insufficient communication of IT infrastructure and network interconnection,

- Insufficient technical strength

3, for the core components, there is no end-to-end professional company, just for every single part. etc.

I am sure you will all agree with me that the Chinese market has experienced this stage just five or six years ago. As a professional data service provider, we have experienced the entire process from information construction, Internet transformation, to digital transformation of Chinese enterprises and government agencies. Have deep insights and rich experience in the needs of enterprises and the management of data assets. We look forward to sharing this experience with countries along the Belt and Road to help businesses grow in more enterprises and government agencies.

in next chapter,I will introduce our solution in data area.