金融科技:解放或法律责任(英文版).pdf

50墨值下载

www.juniperresearch.com

FINTECH ~ LIBERATION OR

LIABILITY

Whitepaper

1

FINTECH ~ LIBERATION OR LIABILITY

1.1 Market Introduction

1.1.1 What is Fintech?

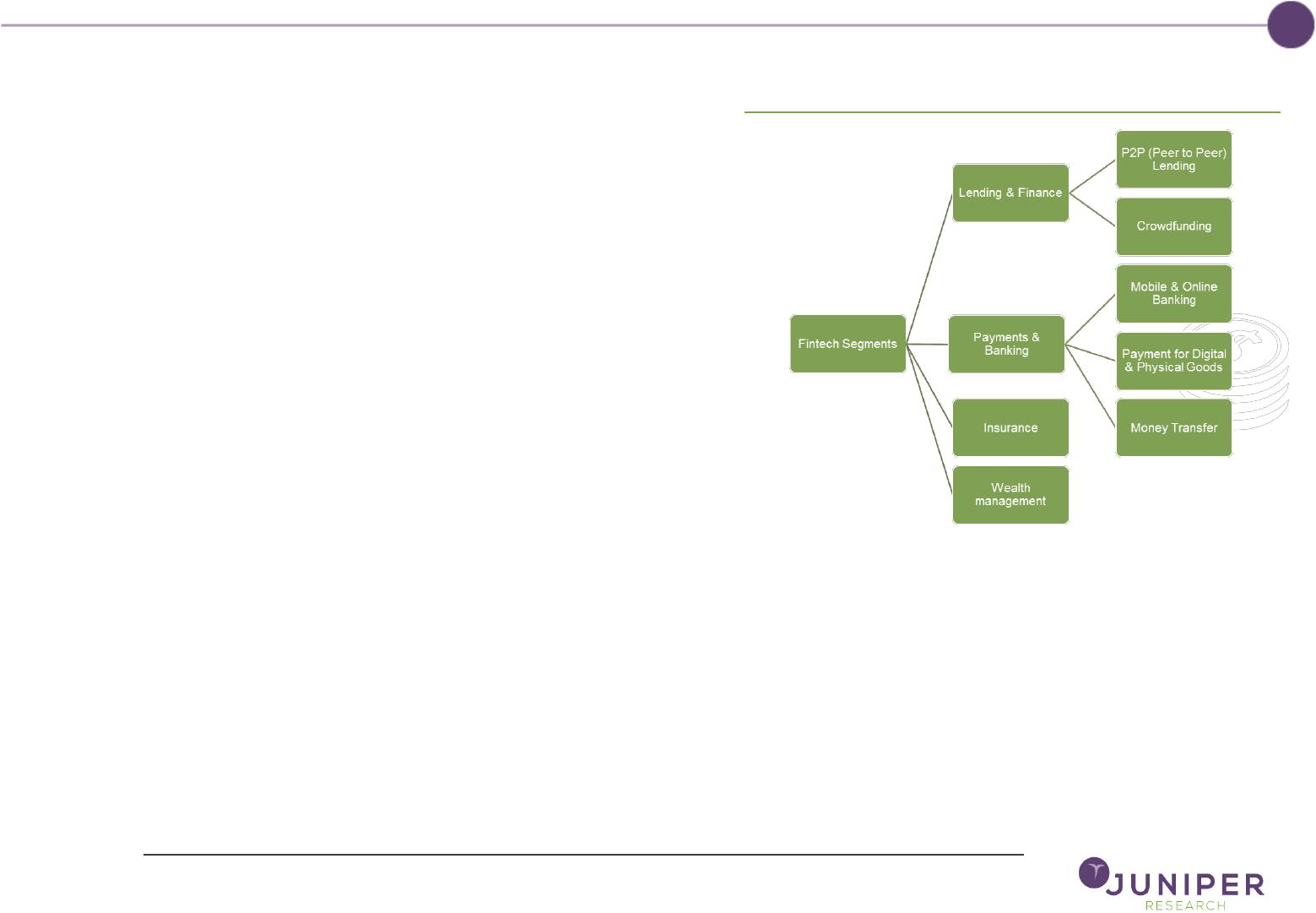

Juniper defines fintech as the use of technology to underpin delivery of

financial services (bank accounts, payments, insurance products, financial

planning and trades). This research covers both B2C (business to

consumer) and B2B (business to business) application across the below

sectors:

Banking (current, business and savings accounts, overdrafts, loans)

Payments (payment processors, payment cards and billing)

Money transfers and remittance

Lending (underwriting loans and providing lending platforms)

Equity financing

Insurance (supporting underwriting and claims processing)

Wealth Management (helping individuals manage their money)

There are numerous factors driving the adoption of fintech products. In the

developing world, suppliers are looking at ways to provide services to

individuals who previously have never used financial services (often

referred to as ‘unbanked’).

As mobile phones penetrate rural areas suppliers are helping people

obtain credit and store their income.

Figure 1: Fintech Market Segmentation

Source: Juniper Research

Furthermore economic growth fuelled by a young and educated population

and a growing middle class overall has fuelled a desire to replicate

lifestyles in the developed world.

Rising income levels have driven demand for insurance and wealth

management products, plus lending levels are expected to rise rapidly

because lenders have more datapoints to evaluate as individuals

increasingly use cards and mobile payment platforms.

of 6

50墨值下载

【版权声明】本文为墨天轮用户原创内容,转载时必须标注文档的来源(墨天轮),文档链接,文档作者等基本信息,否则作者和墨天轮有权追究责任。如果您发现墨天轮中有涉嫌抄袭或者侵权的内容,欢迎发送邮件至:contact@modb.pro进行举报,并提供相关证据,一经查实,墨天轮将立刻删除相关内容。

下载排行榜

评论