20190830摩根大通全球数据.pdf

50墨值下载

Economic Research

August 30, 2019

Global Data Watch

Central banks need to engage government to address their constraints

US growth holds up but global drag is washing onto its shores

2020 fiscal easing remains an EM Asia story so far

Next week: Tariffs up; Powell talks; August PMIs and US payrolls

You dance with the one that brung ya

Rapid-fire geopolitical news and elevated global recession risks naturally take

focus away from underlying challenges facing the global economy. Arresting two

decades of weakening demographic and productivity trends (“the global supply

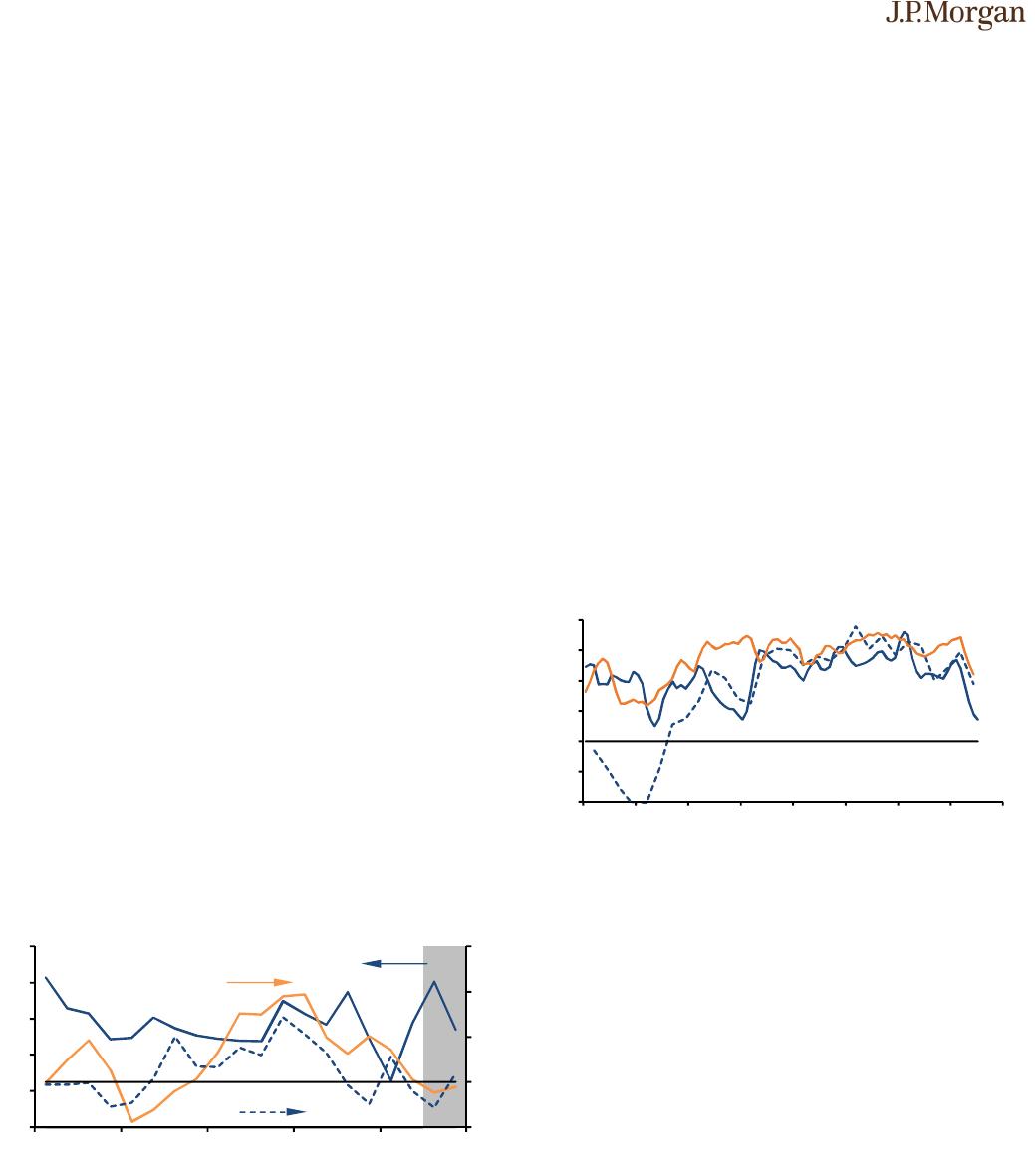

slide”) is a central one (Figure 1). With the reverberations of the financial crisis

magnifying this slide, persistent weak wage gains, rising income inequality, and

public sector debt are altering the political landscape. These alterations are not,

however, generating policy responses that address underlying problems. Instead, a

rising tide of populism and nationalism in geopolitical conflicts—trade and Brexit

among others—is further damaging global growth prospects. The biggest medi-

um-term risk is that this rising tide establishes a sustained adverse feedback loop

whereby economic pressures produce counter-productive political responses.

Against this backdrop, central banks have been pressured to engage in the

political process. Former New York Fed president William Dudley opined

this week that “if the goal of monetary policy is to achieve the best long-term

economic outcome, then Fed officials should consider how their decisions

will affect the political outcome in 2020.” Similar advice has been offered

elsewhere. During the Euro area sovereign crisis the ECB was often advised

to set policy to pressure governments to address EMU’s institutional flaws. In

pre-Abenomics Japan, it was regularly suggested that the BoJ refrain from

easing to pressure its government to tackle Japan’s pressing structural needs.

This advice is misguided, in our view, notwithstanding the limited leverage

central banks have in influencing politics. Modern monetary policy is built on

the idea that the business cycle is managed best when central bankers are insu-

lated from political pressure. By attempting to influence politics, central

bankers undermine the case for their operational independence. In addition,

effective monetary policy transmission depends on markets having a clear

understanding of their objectives and reaction function. Intermittent breaks in

this framework to influence political outcomes would undermine the credibil-

ity and effectiveness of monetary policy.

-2.0

0.0

2.0

4.0

1.2

1.7

2.2

2.7

3.2

01 04 07 10 13 16 19

%oya; both scales

Figure 1: DM wages and productivity

Source: J.P. Morgan

Wages

Productivity

-10

-8

-6

-4

-2

0

23

4

5

6

7

8

9

10

11

56 63 70 77 84 91 98 05 12 19 26

%

Figure 2: US u-rate and federal deficit

% of GDP

Source: CBO, J.P. Morgan

Deficit (with

CBO fcst)

U-rate

Contents

US-China will weigh more on Japan's

growth than US-Japan 10

ECB will likely view further easing as

effective 14

Debt crises in Asia and their lessons for

China 17

Brexit: Preparing for an early general

election 21

India: An implicit fiscal stimulus 23

Australian labor supply: Demographic lags

and NAIRU drags

26

Global Economic Outlook Summary 4

Global Central Bank Watch 6

Nowcast of global growth 7

Selected recent research from J.P. Morgan

Economics 9

Data Watches

United States 28

Euro area 36

Japan 42

Canada 46

Mexico 48

Brazil 50

Argentina 52

Peru 54

United Kingdom 56

Emerging Europe 58

South Africa & SSA 62

Australia and New Zealand 64

China, Hong Kong, and Taiwan 66

Korea 69

ASEAN 71

India 75

Asia focus 77

Regional Data Calendars 80

Bruce Kasman

(1-212) 834-5515

bruce.c.kasman@jpmorgan.com

JPMorgan Chase Bank NA

Joseph Lupton

(1-212) 834-5735

joseph.p.lupton@jpmorgan.com

JPMorgan Chase Bank NA

Michael S Hanson

(1-212) 622-8603

michael.s.hanson@jpmchase.com

J.P. Morgan Securities LLC

www.jpmorganmarkets.com

2

Economic Research

Global Data Watch

August 30, 2019

JPMorgan Chase Bank NA

Bruce Kasman (1-212) 834-5515

bruce.c.kasman@jpmorgan.com

Joseph Lupton (1-212) 834-5735

joseph.p.lupton@jpmorgan.com

Michael S Hanson (1-212) 622-8603

michael.s.hanson@jpmchase.com

But even independent central bankers need to respond to poli-

cy actions that affect the macroeconomic outlook. Whether it

is Brexit or the US-China trade conflict, judgments about pol-

icies need to be made that will differ from the judgments of

those making policy. That this sparks public debate and criti-

cism of central banks is appropriate, as long as their opera-

tional independence is respected and central bankers act in

good faith and are held accountable for their actions.

It is troubling to think that central bankers would take a con-

frontational political stance at a time that their constraints

require closer coordination with elected officials. In particu-

lar, the next recession is likely to see each G-4 central bank

facing an effective lower bound constraint. Their unconven-

tional tools—QE and enhanced forward guidance—will likely

prove less effective as a result of the past decade’s r* drop

and yield curve flattening. This points to the need to prepare

for the next recession now by putting in place facilities by

which monetary, fiscal, and regulatory authorities can move

in a rapid and coordinated counter-cyclical fashion.

US consumers and labor markets are okay

Experience shows global recessions emanating from the US.

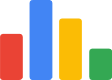

However, this time is different. The business sentiment shock

has been largest in Western Europe and Asia with other coun-

try-specific shocks holding back EM, notably Argentina and

Turkey. The risk is that global weakness washes onto US

shores kicking the more traditional dynamic into gear.

Recent US reports point in this direction as exports and capex

contract and business confidence slides (Figure 3). But the

economy continues to deliver 2% growth around midyear.

This resilience reflects continued solid labor market perfor-

mance—we forecast a 150,000 August job gain next week—

and strong consumer spending. Households have been on a

tear, delivering 4.6% ar in real spending gains in the first sev-

en months of the year. A decline in consumer confidence sug-

gests a cooling ahead. But this week’s July report points to a

faster than 3% ar gain this quarter, providing an important

cushion at a time that global drags look set to be intensifying.

German sentiment and jobs are a concern

With the Euro area experiencing a more troubling 1H19 loss

of growth momentum, it is comforting to see the composite

flash PMI and EC economic sentiment index both move high-

er this month. However, Germany remains a weak regional

link and labor demand is cooling. Employment gains slowed

to a 0.4% ar in the three months through July, half its 1H19

pace (Figure 4). Take-up of the government’s short-time work

subsidy scheme remains very low as companies continued to

report elevated labor shortages. But with the IFO expectations

component falling further this month, this cooling suggests

downside risk is rising for Europe’s largest economy.

With growth risks high and core inflation stuck around 1%,

the case for broad-based ECB easing is strong. However, the

ECB’s hawkish camp aggressively pushed back on this view

this week. They grudgingly accept a rate cut, but remain op-

posed to tiering and to QE in particular. We remain comforta-

ble that the ECB will deliver a rate cut and more QE, along-

side guidance to beef up the impact of its actions. But this

week’s ECB talk suggests a healthy debate is coming and that

there are two-sided risk around the outcome.

Italy shows Mother of Parliaments the way

PM Johnson’s decision to suspend Parliament constrains the

time available for the Commons to restrict his push toward a

no-deal Brexit at end-October. But it also exposes the lengths

to which his administration will go to deliver his objective,

galvanizing the opposition. The stage is hence set for a show-

down starting next week. MPs will challenge the prorogation,

and attempt to pass a law forcing Johnson to request an Arti-

cle 50 extension, with a no-confidence motion and replace-

ment of the Johnson administration possible if necessary. Our

best guess remains that MPs will succeed in blocking the no-

deal path, and Johnson will be forced toward calling a general

-5

0

5

10

15

0

1

2

3

4

5

15 16 17 18 19

%chg over 2q, saar; both scales

Figure 3: US real GDP components

Source: J.P. Morgan

Private consumption

Exports

Equipment

-1.0

-0.5

0.0

0.5

1.0

1.5

2.0

12 13 14 15 16 17 18 19 20

%3m3m, saar

Figure 4: Global employment

Source: J.P. Morgan

Global

(thru Jun)

Germany

(thru Jul)

Euro area

(thru Jun)

of 88

50墨值下载

【版权声明】本文为墨天轮用户原创内容,转载时必须标注文档的来源(墨天轮),文档链接,文档作者等基本信息,否则作者和墨天轮有权追究责任。如果您发现墨天轮中有涉嫌抄袭或者侵权的内容,欢迎发送邮件至:contact@modb.pro进行举报,并提供相关证据,一经查实,墨天轮将立刻删除相关内容。

下载排行榜

评论