2022年中国投资策略展望:尘埃落定后会是更好的一年(英)-瑞信-2022

5墨值下载

China Market Strategy

Outlook 2022: A better year when the dust

settles

Strategy | Strategy

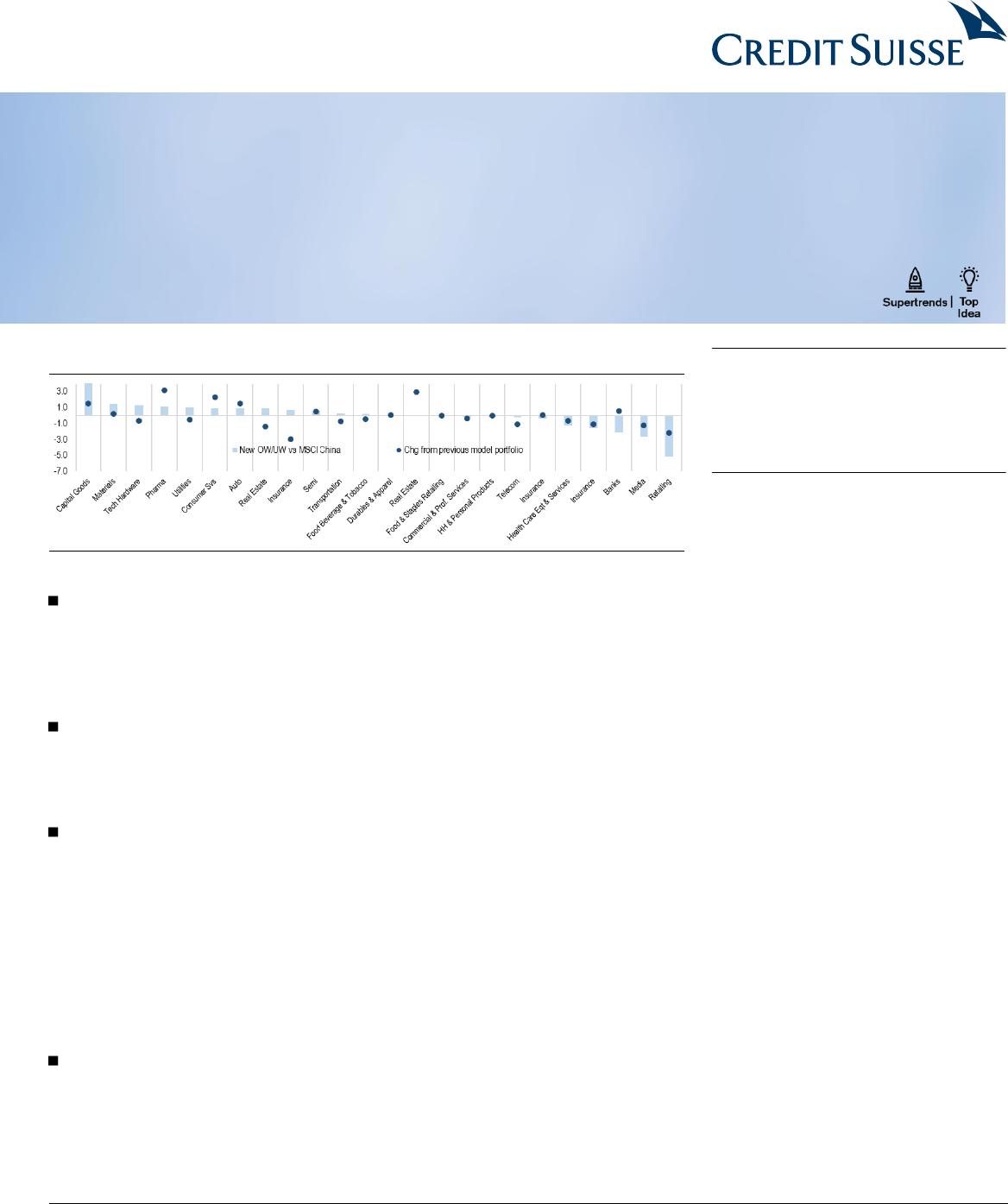

Figure 1: New sector weighting of CS China model portfolio

Source: Refinitiv, Credit Suisse estimates

Macro economy set to bottom out. Following a V-shaped recovery in 2020, China’s

growth lost momentum since 3Q21 due to resurging COVID, summer flooding, unexpected

power cuts and property tightening. We expect to see moderate recovery in 2H22, after a

still tough 1H22. We expect China to speed up fiscal expenditure, carry out a constructive

monetary policy and adjust the implementation pace for China’s long-term development

goals such as common prosperity and carbon neutrality.

On-the-ground checks suggest a mixed outlook. According to the CS CQi team’s

industry and consumer surveys, property sales managers confirmed the moderate easing;

material producers are still cautious on demand outlook and expect the high power tariffs to

sustain for longer; private SME manufacturers are cautious about the year while service

providers are more optimistic.

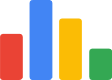

2022 to be a better year for stocks after correction. China and Hong Kong equity

markets experienced remarkable corrections in 2021, with dramatic sector rotation. Sixteen

out of 22 sectors declined, led by consumer services, Macau, software, insurance and real

estate. Only 36% of sectors managed to achieve more positive monthly returns than

negative in 2021, in sharp contrast to 64% in 2020. Downward revision of corporate

earnings was also not helpful. However, the central government is swiftly taking action to

stabilise the economy, and fine-tuning macro and industry policies accordingly, which sends

a positive policy signal. We expect China’s equity market is set to recover, given positive

policy direction, low investor expectation, and cheap valuation, despite a near-term slowing

economy. Our new index targets for MSCI China/HSI/CSI300 are 91/26,200/5,760,

offering 11.7%/13.4%/17.0% upsides respectively.

Focus on bottom up. We continue to expect multi-year secular themes to play out in

2022 but take a more bottom-up approach in sector selection, given lack of clear direction

of style and sector rotation. Our top 5 sector-relative weightings are industrials (+4.2%), IT

(+1.6%), materials (+1.5%), utilities (+1.0%) and energy (+0.8%), versus big under-

weights in consumer discretionary (-3.2%), communication services (-2.9%) and financials

(-2.8%). We had the largest increases in real estate (+3.0%), healthcare (+2.6%), and

consumer discretionary (+1.8%) and trimmed our big overweighting in energy.

3 January 2022

Equity Research

Asia Pacific | China

DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS,

LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do business

with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could

affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

Research Analysts

Edmond Huang

852 2101 6701

edmond.huang@credit-suisse.com

Contributing analyst:

Kenneth Fong

Charles Zhou

Bin Wang

Kyna Wong

Yang Huang

Horace Tse

Alex Liu

Jianping Chen

Hu Shen

Gary Zhou

Chaolien Tseng

Ivy Ji

Lok Kan Chan

Iris Zheng

Jasmine Wang

Ashley Xu

Jason Liu

Peter Li

Clive Cheung

Ting Wang

Timothy Chau

Frank Zheng

Jocelyn Zhang

Veronica Song

Harriet Liu

Summer Wang

Sabrina Shao

Daniel Cui

Moxy Ying

Nathan Chen

Kin Nang Chik

3 January 2022

China Market Strategy

2

Focus charts

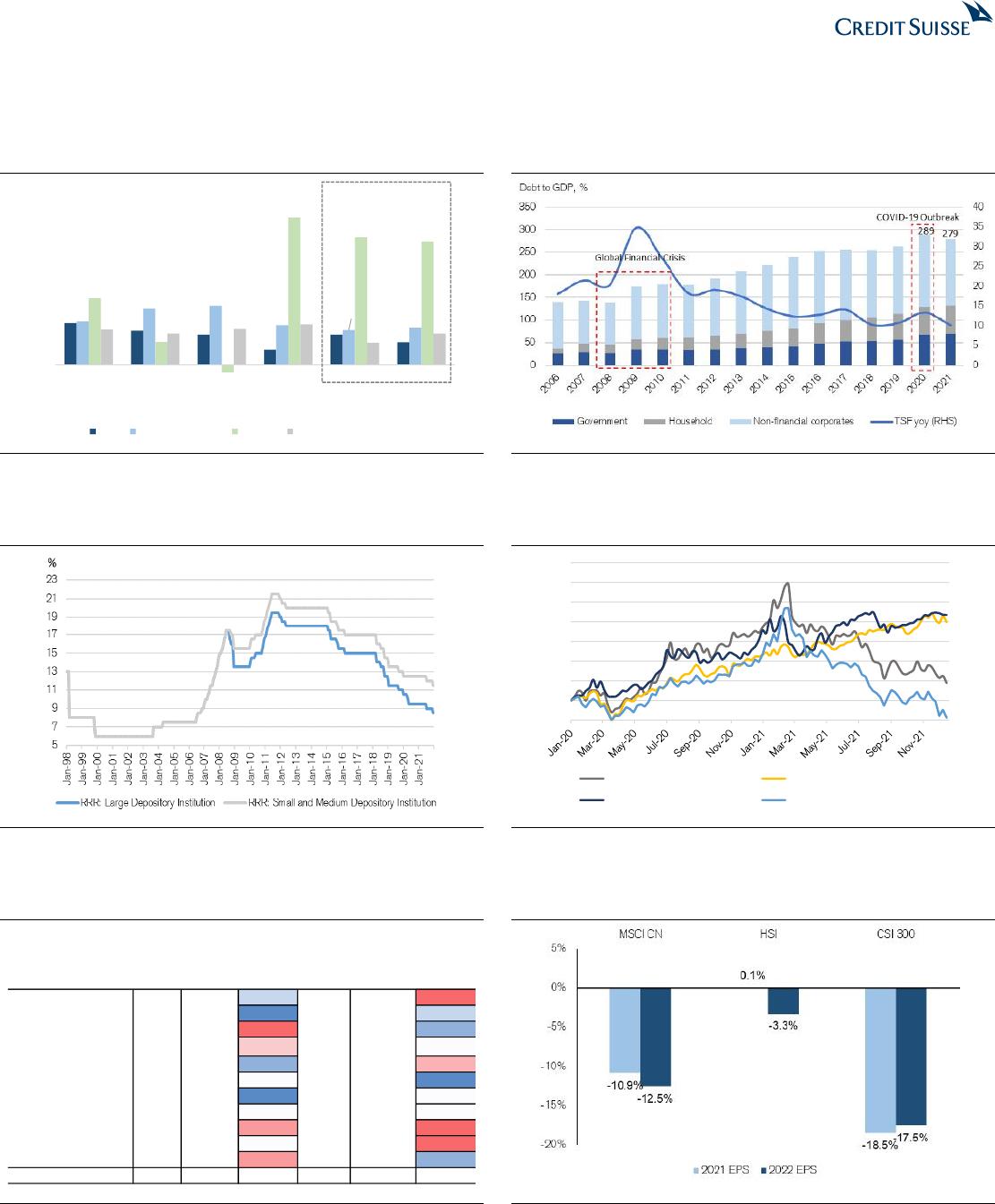

Figure 2: Major indicators two-year CAGRs—from 11M 2019 to

11M 2021

Figure 3: China has a higher degree of tolerance towards macro

leverage

Source: NBS, Credit Suisse estimates

Source: BIS, PBoC, Credit Suisse estimates

Figure 4: RRR—large vs small and medium financial institutions

Figure 5: Performance of NASDAQ100 & ChiNext Index

diverged from HSTech & NASDAQ Golden Dragon China Index

Source: Wind, PBoC, Credit Suisse estimates

Note: Rebased to 03-Jan-2020, data updated to 17-Dec-2021.

Source: the BLOOMBERG PROFESSIONAL™ service;

Figure 6: Number of months posting gains/losses by sector

Figure 7: 2021 YTD revision of 2021E EPS and 2022E EPS

Note: Hit rate calculated as the number of sectors posting more than 6 months of

gains divided by the number of total sectors.

Source: Refinitiv, Credit Suisse

Note: Data as of 17-Dec-2021.

Source: Refinitiv, Credit Suisse

5.2%

3.9%

6.0%

6.4%

22.0%

21.2%

3.8%

5.4%

-5%

0%

5%

10%

15%

20%

25%

30%

11M2017 11M2018 11M2019 11M2020 11M2021 11M2021*

FAI Real Estate FAI Export Industrial production

2-year CAGR

from 11M2019

YoY

80

100

120

140

160

180

200

220

240

Hang Seng Tech Nasdaq 100

ChiNext NASDAQ Golden Dragon China Index

No. of

months

with gains

No. of

months

with losses

Ratio

No. of

months

with gains

No. of

months with

losses

Ratio

Consumer Discretionary 8 4 0.67 4 8 0.33

Consumer Staples

10 2 0.83 7 5 0.58

Energy 4 8 0.33 8 4 0.67

Financials

6 6 0.50 6 6 0.50

Health Care 9 3 0.75 5 7 0.42

Industrials

7 5 0.58 9 3 0.75

Information Technology 10 2 0.83 6 6 0.50

Materials

7 5 0.58 6 6 0.50

Real Estate 5 7 0.42 4 8 0.33

Communication Services

7 5 0.58 4 8 0.33

Utilities

5 7 0.42 8 4 0.67

MSCI China

8 4 0.67 4 8 0.33

Hit Rate

64% 36%

2020

2021

of 79

5墨值下载

【版权声明】本文为墨天轮用户原创内容,转载时必须标注文档的来源(墨天轮),文档链接,文档作者等基本信息,否则作者和墨天轮有权追究责任。如果您发现墨天轮中有涉嫌抄袭或者侵权的内容,欢迎发送邮件至:contact@modb.pro进行举报,并提供相关证据,一经查实,墨天轮将立刻删除相关内容。

下载排行榜

评论